Contents

People generally live for a happy retirement life. So just think, after working for many years, you are now retired and maybe traveling the world. Everyone dreams of such a happy period. On the other hand, if you do not live in a developed country, unfortunately, it is difficult to realize this dream.

For this reason, there are additional or complementary systems to social security systems in many countries. The answer to the question of “What is Private Pension System (PPS)?” comes into play exactly here. If you made small monthly additional payments for a happy old age while working in your youth, these will increase in value over the years and contribute to your post-work life.

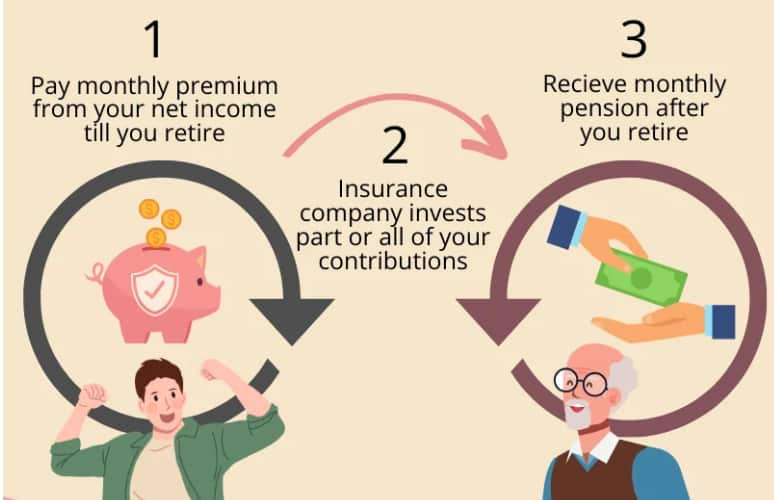

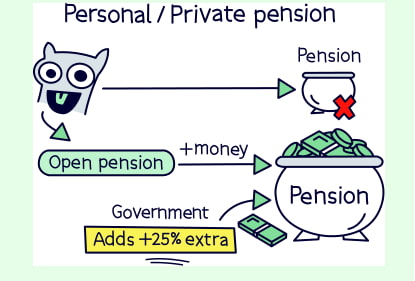

Essentially, individual retirement is a “voluntary” savings and savings system designed for people to have an additional source of income during their retirement. In this system, participants create savings in the long term thanks to the regular contributions they make, and especially in some countries, they have the opportunity to increase their investment returns by being supported by the contributions provided by the state.

Thus, the financial savings habit and discipline established from an early age provides significant assurance against possible economic uncertainties in the future. This system is quite well-known and popular in countries where financial literacy is high. For example, in countries such as Japan, Switzerland and Canada, participation in this system is quite high.

In this article, we will discuss the basic features of the private pension system (PPS), the advantages it offers and the important points to consider during the participation process. You will also discover how you can make your retirement planning more effective with detailed information about the operation of the system. Our aim is to provide a comprehensive guide that will enable you to take conscious steps towards your financial freedom.

What is Private Pension? Basic Features of the System

In its simplest sense, it is a savings or investment tool that helps us save more when we are young and live a little more comfortably and flexibly when we are old. It has become increasingly popular internationally in the last twenty years. The individual retirement system is a voluntary savings system that allows salaried employees, company partners or self-employed real person traders to save for the future and earn additional retirement income. This system aims to create long-term financial security and offers regular payment plans to participants. It is also supported by additional incentives such as state contributions and tax advantages in many countries.

This system is financed by the regular contributions of those included in the system, and these contributions are directed to various investment instruments by professional portfolio managers. In this way, risk distribution is ensured and higher returns are targeted in the long term. In this sense, individuals have the opportunity to invest in the future by choosing from investment options suitable for their risk profiles at certain periods. In other words, this portfolio, which can be distributed according to funds, can be invested and evaluated periodically in assets such as stocks, gold or government bonds.

When it comes to what is private pension, it is clear that; This system is based on voluntary participation, unlike compulsory retirement systems. Therefore, participation is entirely up to the individual and offers flexible payment options. This feature of the system allows individuals to develop strategies that are in line with their personal financial goals when creating their own retirement plans.

In addition, you can freeze your monthly payments at certain periods. However, many companies may request payments such as penalty payments after short freezing periods such as three months.

PPS Participation Process and Required Documents

Let’s say you can set aside certain amounts, even if they are small, on a monthly basis. In addition, you have answered the question of what is private pension and have thoroughly understood the system. You have also decided to enter such a system that will provide you with a small financial contribution when you get older. So how is PPS participation done and how does the process work? Let’s try to explain it briefly if you wish. In fact, joining the private pension system is a very simple and fast process.

In the first step, candidate participants choose the most suitable pension company or bank for themselves and register to the system. The application process is usually carried out through online platforms, through employees working at a bank branch or through contracted agencies.

The documents required for participation include a photocopy of your ID, ID number or tax number, residence document and documents showing your income status. Income document is not among the mandatory documents. In other words, people who do not have a documented monthly income but are housewives can easily enter this system. By the way, it should be noted that many banks allow you to make your monthly participation share payments with their own credit cards like shopping.

Thus, the monthly individual retirement contribution received from this credit card every month can earn you points just like a purchase. You make your payments directly to your credit card.

The documents during the participation process help to speed up the system entry process and ensure that the application progresses smoothly. This is also crucial for the subject of what is private pension. Each institution takes care to ensure that the documents are complete and complete. After the application process is completed, the participants are asked to sign an individual retirement contract and are given detailed information about the operation of the system.

Things to Consider in Private Pension System

It should be noted at the very beginning that; before joining the individual retirement system, it is important for investors to make a careful analysis. It should not be forgotten that; since this system requires long-term savings, it is important to continue the strategy without getting caught up in short-term fluctuations. In other words, if you go and look at how much your money in PPS funds is worth every month, you may be upset. This investment should be considered for a minimum of five years.

In addition, factors such as the performance history of the funds and management fees should also be taken into account. Considering the fact that every investment involves a certain risk, it is important for individuals to analyse their own risk tolerance well. Let’s not forget that there are certain rules in most countries to deserve state contribution. We recommend that you read these rules and legislation on the International Centre for Pension Management website for example.

In addition, another important issue regarding what is private pension system issues such as early exit and additional fees. Many retirement companies may charge you expenses or commissions such as “fund management fee” or “participation fee” if you want to leave the system before 5 years. In this case, believe me, you may even encounter an expense as much as the amount you invested.

Therefore, you should not enter this system with savings that you will need or plan to exit within 5 years. In other words, participants should be patient and avoid sudden decisions to maximize the long-term return of the system. Regular portfolio reviews and strategy updates are the keys to creating a successful retirement plan.

What is Private Pension? FAQ and Answers!

After all this brief and summary information, let’s briefly review some of the most frequently asked questions and their answers in the answer to the question of what is private pension.

1- Who Can Participate in PPS?

- All individuals who are taxpayers from the age of 18 can participate in the private pension system. In addition, it is possible to participate in the system on your own account for your children under the age of 18, who will be the beneficiaries.

- Participation is completely voluntary and employees, self-employed or retired individuals can participate in PPS.

2- Does PPS have tax advantages?

- Yes, returns earned under PPS are exempt from tax under certain conditions.

- Tax advantage is one of the factors that make participation in PPS attractive. Ask your company for details and the latest status of this advantage.

3- What Happens if PPS is Expired Early?

- In case of early exit, a certain part or all of the state contribution can be withdrawn.

- In addition, early exit penalties and additional deductions may be applied. Therefore, it is more advantageous to participate in PPS for a long term.

4- What Happens if I Do Not Make Regular Contributions?

- Failure to make regular contributions may have a negative impact on investment returns. Fund performance and state contribution are maximized with regular payments.

- In cases where there is no continuity of participation, pension companies may request penalties or commissions. Ask your company for detailed information.

5- How Can I Register for PPS?

- To join PPS, you can apply to authorized banks, insurance companies or investment institutions.

- During the application, a copy of your ID, tax number and documents showing your income status are required.

- You can easily complete your registration online or through bank branches.