Contents

When you see the title, if you are not a banker, have not researched financial literacy, and have not been to financial institutions much in the past, please do not be upset. In this article, we will briefly analyse topics such as “what is a credit score?” and how to increase it?, with jargon that even those who have not received economics education and do not have strong banking knowledge will understand. First of all, let’s state that we should see the subject as a part of our daily lives.

Then let’s give an example. So, think about it this way; while walking on the street in your neighbourhood, someone you know or do not know comes and asks you for some money. Naturally, the first thing you will look at is whether this person is “credible” or “trustworthy”. By the way, let’s emphasize that credit actually means “trust”. If you do not know the person, you go to the residents of your street and ask for the person who asked you for a loan. Let’s say; you lent money and the person did not come back on time and paid you this amount or paid less.

Then, he came back the next day and asked you for some more money again. Please think about what your approach will be.

What is a Credit Score? A Basic Approach for Daily Life

The situation is not much different when you go to the banks and request a commercial or consumer loan. Just like you ask your friends in your street about the situation of the person who wants a loan, banks also question those who want a loan. The place where they make these questions is usually the credit institutions established by the central banks. Their measurement unit is the concept called credit score. According to this score, banks can also classify people as reliable, that is, loanable, or unreliable, that is, not loanable.

For example, imagine that the person who rebels by saying, “Brother, I have delayed my credit card payment once, so what happens, why don’t you give me a loan?” is in the same situation as the person in the neighbourhood who you lent money to and who did not pay you back on time.

What we mean is; in today’s capitalist system based on liberalism, it is easy to blame banks or financial institutions. On the other hand, they are also joint stock companies that work within the legal infrastructure organized by public institutions and aim for profit. In other words, they are basically companies or businesses. (Did you say, “I wish we lived in communism?”)

Why is Credit Score Important? How is It Calculated?

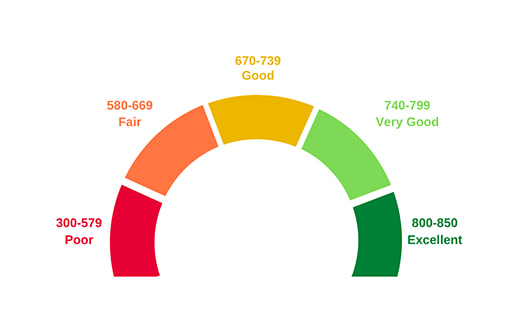

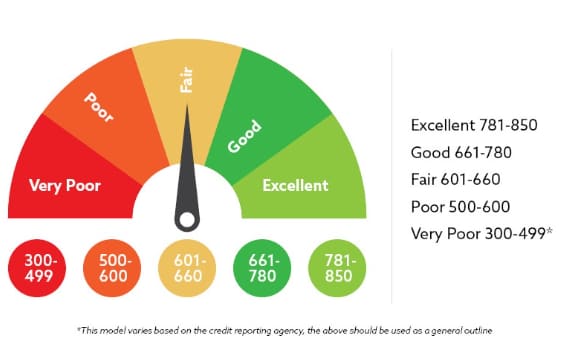

As we mentioned above, credit score, which basically means financial trust, is the name of a scoring system that is used to measure the financial risk of individuals based on their financial present and past. For example, in the United States, this score, which is monitored by a credit institution that is partly public and partly banks, and is a kind of financial reliability measurement, is between 300-850. In other words, if your score is close to 300, your scoring is low, and if it is close to 850, your scroinge is very high. Above 740 is generally considered a high loan rating. Generally, people who come to banks often apply for credit without knowing this unfortunately.

If there is a delay in their payments in the past or in the current situation, their requests are often rejected. Because it is not possible for financial institutions to give credit to customers with a score below a certain score. When they are told that their loan point is low, they immediately start researching methods to increase their score.

Individuals are confused about calculating credit scores. In this context we should say that people who apply for consumer loans, do not need to know how these scores are calculated. It will be enough to focus only on loan rating increasing methods and act in direct proportion to them. If you act like this, your loan rating will increase over time anyway.

Habits are Important for Financial Literacy

The basis of your approach should be that you should make all your payments by the latest due date. In other words, whether it is a credit card or an instalment consumer loan, make sure to pay it on the last day. Do not say, “Oh, I am just one day late, it should not be a problem for the bank?”. Even a one-day delay will lower your score. Remember that even rents are determined and scores are questioned recently accordingly your credit note. Additionally, it is also a very important factor in loan interest rates.

On the other hand, when it comes to how credit scores are determined, it is possible to list them as follows:

– Payment habits: In this period when Artificial Intelligence and digitalization are everywhere, the financial sector has also become quite digital. Here, as a very critical piece of information, we recommend that you pay attention to your bill payments. Delays in bill payments while calculating your credit score now reduce your scoring. In other words, your payment habits in the financial system, including bills, will affect your loan rating.

Financial History Affects Your Credit Score

– Your Financial History: Don’t say, “My student credit card at university was always late, but it’s been a long time.” One of the most important factors affecting your scoring in the digitalized financial system is your financial history. Remember, your history will continue to follow you, even if it is financial.

– Credit Utilization Rate: One of the most important factors affecting your credit score is your current credit usage and limit fullness situation. Think about it this way; if you apply for a loan from a bank and all of your current credit card limits are full, the other party will see this as a risk factor. Since your limits are full, this will lower your loan rating.

– Frequency of Credit Applications: This mistake is very common. In other words, sometimes there are people who apply for a loan online or through mobile phone applications just out of curiosity. Remember that every application you make is perceived by the system as a need, and since this will increase your risk level, your score will decrease. In addition, the moment you are rejected by a bank, other banks will immediately change their positions.

– Indebtedness Status According to Income: As you may appreciate, one of the first things to look at when evaluating a loan application is the income status of the applicant. In other words, the answer to the question of whether this individual can pay the requested amount with his/her current income is very decisive. Of course, if the current indebtedness status is sufficient or high compared to his/her income, there is a high probability of direct rejection. In such cases, if you have side income such as rent or additional income, documenting it will increase your chances of receiving a positive response.

Tips to Improve Your Credit Score and How to Check It?

Up to this stage, we have touched on many issues from what a credit score is to its importance and how it is determined. If these issues are not fully understood, we recommend that you repeat them. If you say you understand, now it is time to list the methods of increasing your scoring. First of all, if we look from a banker’s perspective, please do not rush to cancel your credit card just because the fee has come.

Because each credit card you cancel takes with it your financial history and positive payment habits. In other words, the moment you cancel the card, you lose the positive aspects that come with it. When you think about people who are in need at the marriage or education stage because their scoring is zero or low, who cannot find a loan from their acquaintances or relatives, and who cannot access credit from financial institutions, doesn’t it seem more rational to pay the fee?

If your credit score is zero or low, the first way to increase it is to make your current payments, including bills, regularly and to get a credit card from a financial institution, even if it is very low. You will see that your credit score increases month by month by getting this card, using it every month, even if it is very low, and paying on time.

There are banks that do not give cards to those with low or zero scores, and there may be banks that have a chance of opening a low limit if you present your current income document. If you cannot get it, you have a high chance of getting a positive response if you state that you can block cash up to the limit of the card.

The Check List for your Consumer Loan Scoring!

Increasing your score is not difficult, all you need to do is make your payments regularly, including your bills, and document your income.

Here are some tips to increase your credit score:

– Reduce your current debt status.

– Do not apply for credit or cards frequently.

– Make all your payments, including your bills, on time. Personal finance management is crucial.

– Do not use your credit cards in full limit always.

– Save a little and keep some money in banks. The algorithms will see this.

– Review your limits from time to time and try to increase them. In this way, while your risk remains the same, your debt and credit usage rate will decrease as your limits will increase.

How to Learn and Check Your Credit Score

If you have read this far, it means that you have reached a certain level of financial literacy. From here on, you need to take steps to increase your financial maturity. It should be noted at this stage that, for example, if you are an American citizen, you can visit this relevant government website to learn your credit score and learn the details from there. Remember, you cannot manage what you do not measure or know. After all, your loan rating is a reflection of your financial reliability and you should take steps to increase it.

Finally, it should be noted that in today’s financial world, where artificial intelligence, algorithms and digitalization have encompassed every aspect of life, credit scores are increasing their importance in many areas from interest rates to house rents. Now, even real estate agents request credit points from people as documentation before renting a house. Our duty here is to increase financial confidence and try to maintain our high level by making our payments proportional to our income and increasing our score.