Contents

Sometimes we all run out of money and need a loan. As you can appreciate, asking for a personal loan is not something to be proud of. This is exactly why the capitalist system has put banks into action. Sometimes we borrow small amounts from financial institutions as a consumer loan and sometimes as an additional account. Here lies the answer to the question “What is an overdraft?”

This abbreviation opened as an overdraft account is known among the public as an additional account. In other words, whether it is a salary account or a normal account, the account that allows you to withdraw cash when you have no money left in the account or that pays your bills on your behalf as a “debt” is called an overdraft. The magic word here is that it is a debt. In other words, let’s say you have a thousand USD in your account and your bank has defined a thousand USD additional account or overdraft for you.

If you go and withdraw two thousand USD from your account with your ATM card, half of this money is the thousand USD that belongs to you and the other half is the thousand USD that the bank has defined as a loan to you.

You are expected to deposit this debt back into your account as soon as possible. Because every day, interest will accrue on the thousand USD you withdraw.

Our aim in this article is to analyse the definition, features and advantages of the additional account, also known as the overdraft account, in order to contribute to financial literacy.

What is an Overdraft and How Does It Work?

A credit deposit account is a financial product that provides us with a “short-term” credit usage opportunity offered by banks. Please pay attention to the “short-term” part here. In other words, additional accounts have both lower limits and shorter terms compared to housing-mortgage loans, vehicle or car loans or consumer loans. When you use an additional account, the bank expects you to close it in a short time and use it again later.

In this borrowing instrument, even if there is not enough balance in the customer’s main deposit account, transactions can be made within the credit limit determined by the bank. For example, with automatic payment, bills can be paid or cash withdrawals can be made.

While the account is working, there is a systemic relationship between the customer’s money and the defined credit limit. Thanks to this relationship, in cases where a payment needs to be made, the credit limit is also activated in addition to the existing balance in the customer’s account, that is, the money. Thus, sudden financial needs are supported immediately, while customers are prevented from experiencing payment difficulties or falling into delay. This is also important in terms of what is an overdraft.

In addition, overdrafts can be easily managed via mobile and internet banking by working integrated with the digital platforms of banks. This integration offers users advantages such as checking transaction history, monitoring expenses and tracking credit usage. These features of the account are an important reason for preference for individuals looking for financial flexibility and security.

A credit deposit account provides great convenience in meeting sudden cash needs, while at the same time making users’ financial planning flexible. Thanks to this account, customers can make their urgent payments by using additional credit in unexpected situations.

What are the Advantageous of Using ODs?

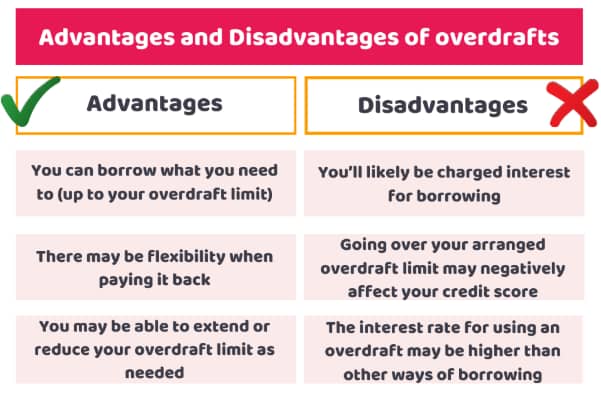

On the other hand, when it comes to what is an overdraft, it is necessary to mention some of its disadvantages. The credit limit defined in the account can negatively affect planned spending habits; in other words, unnecessary credit use can increase the risk of debt.

In addition, the convenience provided by this account type can sometimes weaken financial discipline. Uncontrolled credit use can lead to high interest payments and financial imbalances in the long run. For this reason, budget management and regular follow-up are of great importance within the scope of personal finance management when using an additional account.

Customers need to evaluate the advantages and disadvantages well in the question of what is an overdraft and manage their accounts consciously.

Required Documents for Opening an Overdraft

The opening of an overdraft account is carried out in accordance with the standard procedures determined by banks. For the opening of an account, the customer’s basic financial data such as identity information, income status and credit history are first evaluated. Banks determine the credit limit by taking this information into account and initiate the account opening process. By the way your credit score is also important.

During the opening of an account, the customer is usually asked for documents such as:

- identity document,

- residence document and

- income statement.

These documents allow the bank to analyse the customer’s creditworthiness objectively. The complete and accurate submission of the required documents is of great importance for the smooth progress of the account opening process.

In addition, during the account opening process, banks provide their customers with detailed information about the terms of use, interest rates and repayment plans of the product. Customers can carefully examine this information and evaluate whether it is suitable for them. A conscious choice helps to achieve healthy results in financial management in the long term.

Pros and Cons of Using an Overdraft

When it comes to what is an overdraft, it should be taken into account that it is a debt and its risks. After all, it is a debt and can pose financial risks if not managed correctly. Therefore, it is of great importance for customers to regularly monitor their accounts and stay within the specified credit limits. Risk management is a critical element that both banks and customers should pay attention to.

The biggest risk in account use is that uncontrolled credit use increases the debt burden. Customers are required to use their overdraft accounts only in emergencies and make regular repayments. Banks take various measures to minimize customers’ risks; for example, practices such as spending notifications and limit warnings are put into effect.

In addition, risk management strategies include budget planning and financial discipline. Customers can prevent unnecessary increases in credit use by performing regular income-expense analyses. In this way, financial difficulties that may arise when using an overdraft account are prevented in advance. Conscious and planned use is the most important factor in minimizing risks.

FAQ About What is an Overdraft?

Everyone is sometimes confused about what is an overdraft. In this sense, it is important to summarize and explain the subject and the most frequently asked questions in bullet points.

- How does overdrafts work?: An overdraft works integrated with your main bank account. When there is not enough balance in your account, the defined credit limit is automatically used. In this way, you can make your payments without delay and meet your sudden cash needs.

- How are overdraft limits determined?: When determining the overdraft limit, banks pay attention to the customer’s income status, credit history and financial profile. This assessment ensures that a credit limit suitable for your payment capacity is provided. Thus, unnecessary borrowing risks are minimized.

- What are the advantages of using Overdraft?: An overdraft offers significant advantages in terms of meeting sudden cash needs and providing financial flexibility. Thanks to low interest rates, digital banking integration and easy access, you can easily use it in your daily financial transactions. It also contributes to your budget management by providing additional support in unexpected expenses.

- What should be considered when using Overdraft? : When using an overdraft, it is important to take care not to exceed your credit limit. Creating regular repayment plans and keeping your expenses under control will help you maintain your financial balance. Otherwise, uncontrolled credit use can increase your debt burden. It is also important about what is an overdraft topic.

- How are interest rates determined in overdraft? : The interest rates applied in overdraft vary depending on the policies determined by the banks, market conditions and the customer’s credit risk. Fixed or variable interest rates are generally preferred. The details of the interest rates are explained to you during the application process.

- What documents are required for the overdraft application? : During the overdraft application, an identity document, income statement, residence document and documents showing credit history are usually requested. These documents allow the bank to analyze your credit worthiness objectively and help determine a suitable credit limit for you.