Contents

Everyone knows that the words stock market and wealth go very well together. On the other hand, we must know that especially in the short term; the share markets will not make you rich instantly! So, do not enter these share markets to get rich in the short term. Along with this fact, you should now that if you increase your financial literacy and learn technical and fundamental analysis, the equity market is a good investment tool to evaluate your savings. Of course, it should be noted from the very beginning that such stock market should be looked at in the medium and long term, not in the short term.

Meanwhile, the phenomenon of inflation is also important when evaluating share market earnings. Furthermore. you have to know what is a stock before buying it at least.

In line with that it would be best not to start this business without knowing the most basic financial and economic terms.

What Is a Stock? A Simple Definition

If you are someone who occasionally spends time on social media, you may sometimes see things like: “If you buy this stock, it will be two- or three-fold tomorrow” or “Take this share and put it aside, you will be rich next year.” You may have seen a lot of speculative commentators posting like this. Even people who describe themselves as equity market experts use such statements. Unfortunately, there are some people (small investors) invest directly in such securities without asking themselves what is a stock question.

Accordingly, if you live in a country with a low financial literacy rate, you probably know many people who look at this type of content and immediately want to “play” in the stock market.

In this regard, we would like to point out that; A share certificate is actually a partnership document. So, just as the equity market is not a game (!), stocks are not a toy and will not make you rich in a short time. A share is primarily (!) a partnership document, and naturally, it is an “Investment instrument” in terms of getting a share of the profits of the company you are a partner in!

In this context, we will first briefly touch on its definition and functions and then give brief information about the basic features of the equities and how to buy it, without drowning you in technical terms. As we mentioned before, the stock market is definitely not the right place for you, especially if your goal is to “GET RICH” in the short and medium term. By the way knowing fundamental and technical analysis is very important.

While looking at what is a stock we repeat at this point: “The stock market is not a game place!” and “an equity is an investment tool, not a game of chance!” Don’t pay attention to so-called masters on social media who demand money from you for “education purposes” about getting rich in share markets.

As the name suggests, shares are stocks! While in the past, company shares were distributed in paper form, their prices are now determined according to supply and demand in the electronic environment and in the traditional market logic. Of course, there are many factors that affect supply and demand. In this context, especially in an environment where digitalization has increased so much and information spreads rapidly, the factors affecting the supply and demand of shares and therefore, the trading price also change instantaneously.

Asset Management and How Stocks Work!

As you can understand from here, if you cannot frequently follow stock buying, selling and price screens during the day, this capital market investment tool is not for you. On the other hand, there are also asset management companies that monitor, buy and sell stocks on your behalf. So, you don’t have time, but they do and they manage your portfolio for you in return for a certain commission. These companies actually try to mediate small investments to contribute to the development of the country’s economy by bringing together small investors, creating large portfolios and ensuring that savings are transformed into investments.

Think about it this way, for example, if person A wanted to collect one hundred thousand USD from 10 people and said that he would invest with these amounts, what would your reaction be? Instead, if the same people go to an Asset Management Company that is licensed by the Capital Markets Board and operates in accordance with the regulations, their reaction will be much more positive and they can give their money to this company for investment purposes.

By the way, we are not going into details, but different institutions store these assets and money. Naturally, these institutions also receive licenses from the Capital Markets Boards and act subject to regulations. In this regard, we should note that since the company that manages your portfolio and the companies that provide custody are different institutions, the element of trust is more. When asking what is a stock it is necessary to know these facts first.

How to Buy and Sell Stocks

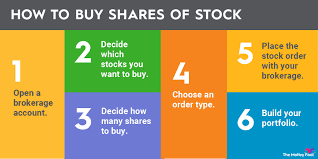

After giving details about the subject of stock definition and the function of asset management companies, let’s answer the other question on everyone’s mind. Now, you increased your financial literacy and identified stocks to buy through fundamental or technical analysis. You also have some money saved aside. It’s time to buy the stock you selected. You must take steps to do this. To buy shares, you must first have an investment account. It’s not just banks that open this anymore.

In other words, while in the past you had to physically go to a bank and open an investment account, now, thanks to technological financial institutions (also called FinTech) and their mobile applications, you can open an investment account, buy and sell stocks even without going to the bank. Of course, all institutions, including banks, will ask you for certain documents and will charge you a commission for every purchase and sale amount. These are indispensable for everyone who learns what is a stock. On the other hand, if you complete the paperwork all at once, no one will probably ask you for paperwork again and again later unless the legislation changes.

After opening an investment account, you can buy and sell stocks at current prices by entering the application of the relevant bank or financial intermediary institution. So, when you look at it from end to end, you do not have to go through a long and difficult process to buy shares.

Tips for Investing in Stock Markets

However, there are a few things you should pay attention to when buying stocks. If we briefly summarize these issues in items;

- Remember that buying stocks is an investment. If you want to get rich in the short term, buy a lottery ticket 🙂

- Thoroughly research the stocks you hear about on social media in depth and conduct technical and fundamental analysis thoroughly.

- As mentioned before the stock market is not a game. The stock market is an investment market whose rules and boundaries are established by the Capital Markets Board which is a government institution.

- It is risky to invest without having detailed information about this market without thoroughly researching what is a stock and what it is not.

- Speaking of risk, investing in the share markets is a risky business and no one can guarantee you a definite profit. Accordingly, there is a risk that perhaps all of the money you deposit will be lost.

On the other hand, you can see the list of NASDAQ comparative online brokers by clicking here.

Basic Rights Provided by Stocks

After clarifying issues such as what is a stock and how to buy shares, we would also like to talk about some of the basic rights or privileges that come with owning shares. After all, you are now a partner of the relevant company and you should have some rights, right 🙂 By the way, do not forget that the rights we will talk about are general rights. In other words, these rights may vary from country to country and according to different legislation. You can find them in capital market books. At this stage, we will touch upon some of the basic items that investors who are interested in what stocks are should know.

In this context, some of the rights that shares provide to their owners are as follows:

- Partnership right; When you buy the company’s stock, you own a partnership share.

- The right to participate in management: With this right, you also have the right to vote.

- The right to receive dividends: If a decision is made at the general assembly, you can receive a dividend from the distributed profit in proportion to your share.

- Pre-emptive right: It is the right to purchase new shares.

- Right to receive free shares: It refers to the right to participate in capital increases free of charge.

- Right to information: The investor has the right to get information from the company.

These rights are the most basic share rights. It is best to do detailed research on the subject on the internet and learn your rights in detail. Finally, we would like to reiterate what we stated at the beginning.

Invest a Stock with Time!

When we explain answer the question of what is a stock, we should think of a partnership certificate and it would be best to see the share market as a medium and long-term investment market rather than an area where you can get rich in a short time. It is also necessary to be vigilant against speculators on social media and people who market shares to people in exchange for money.

Finally, we must state that we need education, knowledge and time to invest in these markets. Otherwise, we are likely to face the risk of losing all our savings in a short time.