Contents

Debts… Yes, this is a single word… However, while it is just a word for some of us, for others it is a serious burden that makes life difficult and damages our mental health. If you are struggling with multiple credit card debts, consumer loans, housing, vehicle or other debts, rest assured that you are not alone. Fortunately, there are some ways to get out of this situation. The most popular of these is “debt consolidation loan” which provides “debt transfer“.

By the way, it should be noted that; most global banks currently spread your debts over up to 36-48 months.

Before starting the topic, it should be noted that; the best thing to do is to keep your current incomes equal to your expenses and not need debt. On the other hand, we all know that no one can manage with their current incomes, especially in times when inflation is so high. So, since we are using debt, it is best to stretch our legs according to our blanket. Well, if we haven’t been able to do that and our debts have increased too much, then it’s time to restructure our credit debts with a debt consolidation loan.

In this review, we will discuss what debt settlement loan and debt transfer are, how it works, its advantages and the points to be considered in a sincere language. It’s normal to be confused about financial matters, but with the right information, you can manage this process much more easily. In this article, where we will proceed in a friendly conversational tone, we will also include practical tips and experiences that will ease your financial burden.

Let’s reorganize your debts and take a step into a more controlled financial life!

What is a Debt Consolidation Loan? Relief with Transfer

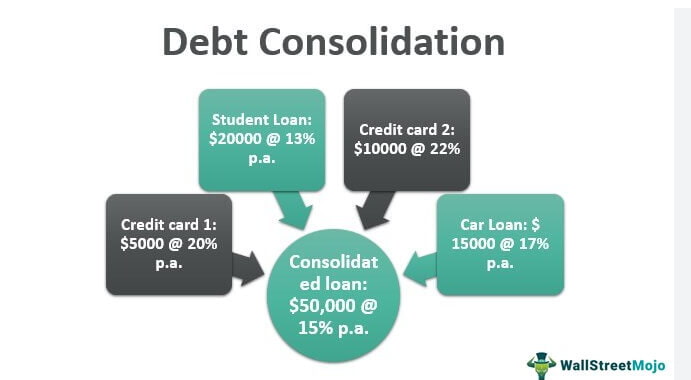

Now think about it this way, you have more than one debt and you have to pay on different dates and with different interest rates every month. Debt consolidation loan is there to put an end to this confusion. Thanks to this loan, you can combine all your existing debts under a single loan. In other words, you combine all your credit card debts, consumer loans, whatever you have with different banks, into a single debt by transferring debts.

Thanks to this merger, you make a single payment every month and usually the interest rate of this new loan can be lower than the average interest rate of your existing debts. This means less money out of your pocket in the long run. In addition, since there is a single payment date, it becomes much easier to keep track of your payments. You no longer have to think, “I wonder which debt was due?”

But of course, there are some points to consider when getting a debt consolidation loan and transferring your debt. First of all, you should make sure that the interest rate of this new loan is really lower. Otherwise, you will just be transferring your debts from one bank to another. In addition, it is important to consider additional costs such as file fees or life insurance applied by banks when getting a loan.

In summary, debt settlement credit and debts transfer can be a great option for those who have multiple debts and want to pay them under one roof and pay them off under more affordable conditions. Especially if you have high-interest credit card debts, you can significantly relax with a debt settlement loan.

Things to Consider During the Debts Transfer Process

When transferring debt, first of all, you need to make a detailed list of your current debts. In other words, clarifying information such as which debt has what interest rate and what the payment terms are will help you make healthier decisions. Then, it is very important to compare the debt consolidation loan interest rates, maturity periods and extra costs offered by banks and choose the most suitable offer. The offer offered by each bank may vary, so you should take your time to do your research.

In addition, before starting to use the loan, you should evaluate whether your new payment plan is suitable for your budget. When consolidating your debts, it is important that your monthly payment amount does not increase and does not strain your budget.

After all, you should never delay your payments with this new debt transfer process. It is important to prevent your credit score from falling even further. In this context, meeting your future financial needs depends on this payment process.

Finally, it is necessary to read the loan agreement thoroughly and not to sign without understanding all the terms.

In this way, you can carry out a planned debt transfer process without encountering surprise costs in the future. Another important issue is the term of the loan, i.e. the repayment period. A longer-term loan may lower your monthly payments, but remember that this may mean paying more interest in total. A short-term loan, on the other hand, increases your monthly payments, but allows you to pay off your debt faster and pay less interest.

The Borrowing is a Burden! Don’t Forget!

Therefore, you should choose the term that suits you best, considering your budget and ability to pay.

Finally, a debt consolidation loan is just a tool, not a magic wand. Although it may be comforting to collect your debts under one roof, if you do not change the spending habits that caused you to get into debt, you may soon find yourself in the same situation again. Therefore, you should see a debt settlement credit as an opportunity, review your budget, and take care to spend more controlled. Remember, the main goal is to get rid of the debt spiral permanently.

Step by Step Stages of Debt Consolidation Loan

- Do Research and Comparison: The first step is to research the debt settlement loan offers of different banks. Try to find the one that suits you best by comparing factors such as interest rates, term options, and costs. You can visit their websites, talk to the customer service of the banks, or use a credit comparison platform.

- Application Process: If a bank you like has an offer, you need to start the application process. This can usually be done online or at a bank branch. When applying, you will be asked for certain information and documents such as your identity information, income documents, and details of your current debts.

- Evaluation and Approval: After you submit your debt consolidation loan application, the bank will evaluate your credit history and financial situation. If your credit score is appropriate and you have sufficient payment capacity, your loan application will be highly likely to be approved. This process may vary from bank to bank.

- Loan Agreement and Signature: When your application is approved, the bank will present you with a loan agreement. This agreement details the interest rate, term, payment plan, and all other conditions of the loan. You sign this contract after reading and understanding it carefully.

- Closing Your Debts: After the loan is approved and the contract is signed, the bank usually uses the loan amount to close your current debts. In some cases, the bank may make payments directly to other institutions you owe money to.

- New Payment Plan: After your debts are closed, you will now have a single loan and a single payment plan. You will start making your monthly payments regularly according to the payment schedule offered by the bank.

FAQ About Debt Consolidation Loan

If we want to analyse the questions and short answers that people are most curious about and ask about debt transfer;

- Which debts can I transfer? Credit card debts are usually the most transferred type of debt. On the other hand, banks can also transfer other debts such as consumer loans under certain conditions.

- What are the conditions for transferring debt? Banks may usually want you to have a regular income, your credit score to be at a certain level, and your current debts to not exceed a certain limit. Let’s not forget that each bank may have different criteria.

- How are debt transfer interest rates? This is one of the most wondered about issues. Banks usually offer low or promotional rates for a certain period of time.

- Do I have to pay any fees when transferring debt? Yes, some banks may charge a fee for the debt transfer process. This fee can be a certain percentage of the debt to be transferred or a fixed amount.

- How does a debt transfer affect my credit score? Transferring debt usually does not negatively affect your credit score. It can even be positive in the long term by helping you manage your debts better. However, there may be a slight decrease in the short term.

- How long does a debt transfer process take? The process can usually be completed within a few days to a week. However, this period may be longer depending on the bank’s workload and the documents it requests.

- How can I find the best debt transfer offer? It is best to compare the debt transfer campaigns of different banks. You can carefully examine the interest rates, term options, fees and other conditions, especially from the banks’ mobile applications, and choose the one that suits you best.