Contents

Many major events took place in the early 2000s, when the world began to change rapidly and technology began to affect every aspect of our lives. We have previously mentioned the consequences of the 2008 global financial crisis, which was at the forefront of these, in terms of the world economy. It is also a known fact that after this crisis, investors turned to much smaller, technology-focused new generation initiatives instead of large and risky companies. These types of initiatives, called startups, which have the potential to grow rapidly and develop new generation solutions to customers’ needs, have spread rapidly all over the world, especially in Silicon Valley in America, especially after 2010.

In this context, while initiatives that prepare a good startup pitch deck or investor presentation can easily access the financing they need, others try to meet their financing needs from their spouses, friends and relatives.

At this point, it should be noted that; these small companies, which do not have much money due to their structure, sometimes need money, that is, investment, during the establishment and sometimes during the growth stages. As we have said that this is often called “Startup Pitch Deck” and is a very popular concept in the entrepreneurship ecosystem. In fact, the term “Elevator Pitch” is also used on this subject, which means a short introduction prepared to impress an investor in an elevator in two minutes.

In other words, instead of confusing the other party by giving all the details at length, it is possible to take as an example the founder of Instagram, who also explained his income model by saying that he was planning to establish a startup where “people share their photos on the internet”.

What is a Startup Pitch Deck? Sample Questions!

On the other hand, angel investors are important for new generation entrepreneurs, and such companies are also very important for investors. Try to put yourself in the shoes of an investor who made a small amount of money for 10 percent of Instagram during the establishment phase.

Imagine how happy you would be if this small investment returned to you in the form of hundreds of millions of dollars thanks to the small technological initiative of that period, which was just a photo sharing application. In this context, there are many companies that have impressed investors and achieved success by accessing the financing they needed while they were still small companies. (Of course, the opposite is also true)

In the meantime, you should definitely present a financial five-year project in your presentation, including where you will use the investment you will receive. This project should definitely include a global expansion and international competitors. In addition, if you have a plan to rent luxury offices or pay salaries of hundreds of thousands of liras under the name of consultants with the investment you will receive, we recommend that you remove this from your presentation and mind right now.

At this point, we would like to briefly state the essential headings in an effective investor presentation:

- Briefly state which problem you solved and how.

- Do you have any other competitors who solve this problem? If so, the competitive situation, in other words, market analysis, is important.

- Quickly introduce your business and income model.

- State the team, in other words, who your team consists of.

- Present a financial projection to the investor. In other words, indicate to him with data how much he invests today, when and with what profit he will get his money back.

Essential Components of a Successful Startup Pitch Deck

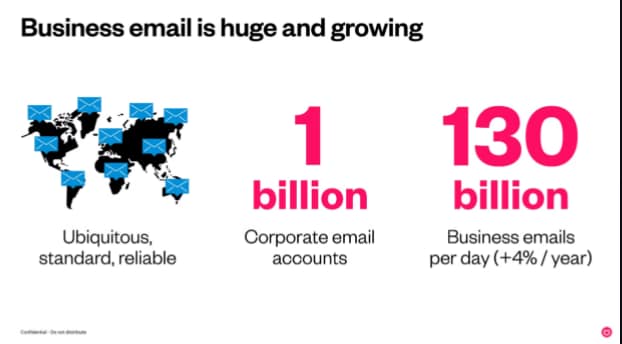

The problem of access to finance for SMEs worldwide is a global problem that has been tried to be solved for many years. After all, these companies are small or medium-sized companies whose financial statements are not healthy and are generally not managed very professionally. If we say that according to research, more than 95 percent of the total number of companies in the world are such companies, we understand the importance of access to money and credit for these companies and the world economy.

Just like SMEs, startups, which are new generation technological entrepreneurs, also experience serious difficulties in accessing finance, money and credit. We have previously touched on this subject, albeit briefly, in the guide to establishing such entrepreneurs and why startups fail. Let’s elaborate on this subject now if you wish.

Angel investors or venture capital companies, called VC (Venture Capital) in the entrepreneurship ecosystem, invest in technological startups that they see potential.

At this point, it should be emphasized that these people or companies pay attention to the following basic features in the startup pitch deck and firms they invest in:

- How many people are there founders and are there any software developers among them?

- What is the conflict and harmony between the founders?

- Is the startup in the idea stage or has an MVP emerged?

- If it is in the idea stage, is it realistic?

- Is the product or service only local or does it have a chance to GO GLOBAL?

- Does the product or service really meet a need?

- Is there a chance to scale easily?

- Is the company’s valuation realistic?

- What are your KPIs (Key Performance Indicators)?

Answers to these questions will be as important as impressive slide performance of your presentation and your startup pitch deck.

Best Practices for Designing Your Presentation

Most founders focus on impressing the other party when preparing a startup pitch deck. This is the right move. However, confusing the means with the purpose will lead to negative results. For example, a presentation in which you cannot show the investor what problem you are solving and what kind of income model you will make money with with data will not be effective, no matter how beautiful the visuals are supported. The investor basically wants to be able to predict from your presentation when and with what profit he will get back the money he invested. In other words, supporting this presentation with realistic, accurate and reliable data is as important as impressing him with a cool presentation.

We would like to state here that; your slides become important in these days of institutions that organize demo days, that is, special days that bring startups and investors together, such as acceleration programs. In other words, you are on stage at that moment and the angel investors or VCs watching you are focused on you. Here, if you make good explanations supported by data on an impressive presentation, your chances of getting investment will increase. Put yourself in the shoes of the other party and imagine that you invested the money you wanted to evaluate in an entrepreneur who made a presentation that did not impress you.

At this point, we would like to state that world-famous angel investors spend an average of two minutes to understand and get to know startups. In this short introduction, also known as Elevator Pitch, it is important to quickly explain what problem you are solving and what kind of income generation model you have in two minutes.

Tips for Delivering a Persuasive Pitch

One of the most important things to consider when preparing a startup pitch deck is the team. In other words, someone who is considering investing in you will want to see which team you will work with after your business and income model. In this context, it is clear that new generation technological startups that cannot be a solid and harmonious team are doomed to fail in the medium term, no matter how strong their business model is. Past bitter experiences also support this claim. A startup with team members who cannot get along with each other will soon start to experience serious problems.

This is a significant problem that may lead to the closure of the company. It is also important how much the team members are dedicated to this business. Many startups whose founders left the business after a while due to working at an extremely busy pace have faced the risk of closure.

Ultimately, for a good startup investor presentation, it is very important to do research in advance and support your startup idea or the product-service you have created with data. What investors care about most is how much profit they will get back for the money they invest and, in relation to this, whether your venture has the potential to expand abroad. If you are a venture that does not have high profit expectations and will only stay local, no matter how cool and good your presentation is, unfortunately, your chances of getting investment will be low.