Contents

In the last 20 years, many new needs and concepts have entered our lives with the incredible progress and development of the internet and technology all over the world. We mean, who would deny that the internet, which perhaps did not exist 20 years ago, is a necessity today? However, terms and definitions that we have never heard before have entered our world with technological advances. On the other hand, it has always coincided with the same period when we hear success stories about a few friends from Silicon Valley in America coming together and taking the first step of billion-dollar companies. Naturally, some of the new terms we hear in these stories have always aroused our curiosity.

Honestly, we wonder what people understand when we say start-up. Unfortunately, when we hear definitions of the start-up ecosystem such as seed investment, angel investor, entrepreneurship ecosystem, MVP, POC or exit, we often prefer to stand aside and listen.

At this point, we will provide you with simple and entry-level definitions of start-up ecosystem, without going into the basics. We are trying to help you enter this amazing world. Remember, if you have an entrepreneurial spirit and have good ideas in your mind, you have to start somewhere.

What is Start-up? Definition and Evolution of a Startup

In its simplest definition, start-up means new generation technological initiative. In other words, as we can understand from its name, it means a new generation enterprise or company based on technology and established to meet a need. The two most fundamental issues in this definition are the concepts of technology and need. If we understand these two concepts, we will already understand the difference between start-ups and traditional companies. Think of it this way; Classical companies generally do similar work to each other and try to gain market share by producing the same or similar products.

Let’s take a textile company or a construction company. The products these companies produce or the services they provide are not unique ones. On the other hand, in order for a start-up, which we also call a new generation technological initiative, to come to life, it must first have technological infrastructure (such as an app or website) and have been launched to meet a need. The best examples we will give here will be the Uber or BlaBla-Car applications. Actually, it is a good example for someone who drives from one city to another to rent their empty seats in order to both reduce their costs and have a traveling companion.

These types of new generation entrepreneurship examples emerged out of necessity and are technology-based innovative inventions. However, not every initiative that involves technology is a start-up. So for instance, just selling shirts online is not an example of it.

Features of Startups and More

These types of new generation initiatives have some similar and common features. Ultimately, if we have to list the 5 basic features of start-ups;

- The number of founders is generally between one and five.

- It has vertical, that is, exponential and rapid growth potential.

- It is based on technology and innovation.

- The number of employees is small and the majority is software developers.

- It was established to provide a service that is not to meet a need.

Entrepreneurship and Startup Ecosystem: Funding, Mentorship, and Growth

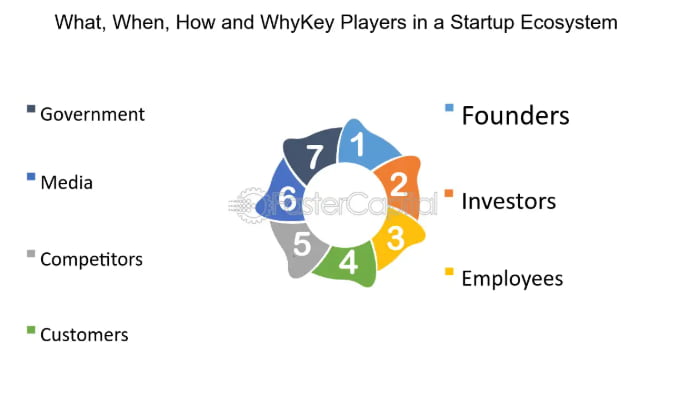

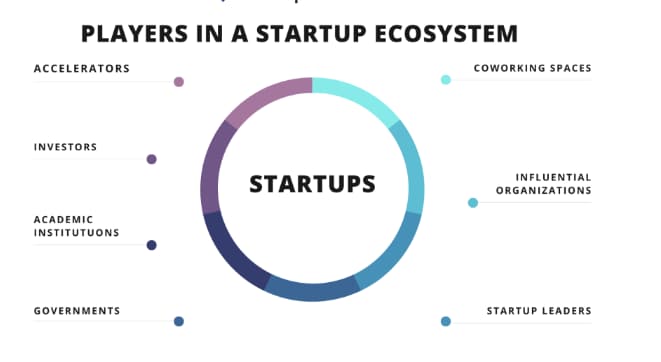

We hear this phrase a lot from new generation technological entrepreneurs. Ecosystem, as a word, refers to the contact and intertwining of more than one discipline. Along with this, when we talk about the entrepreneurship ecosystem, we should think about its stakeholders. In other words, as we will give definitions below, the founders, angel investors, acceleration programs, corporate investors, VCs and other stakeholders are all called the entrepreneurship ecosystem.

If we briefly list the elements of the entrepreneurship ecosystem:

- Start-ups

- Founder and Co-founders.

- Angel Investors

- VCs (Venture Capitals)

- Acceleration Programs

- Crowd-funding Platforms

- Technology and Incubation Centers

At this point, we would like to briefly touch upon the story of how the entrepreneurship ecosystem in the world has come to the fore in the last 15 years. As we may remember, with the collapse of Lehman Brothers in 2008, large global companies went bankrupt with the Global Finance and Debt crisis that affected first in America, then in Europe and almost all over the world. In this period, when even the so-called unsinkable companies went bankrupt, the importance of small and widespread, less risky companies around the world came to the fore. Especially technology-based start-ups with high growth potential have come to the agenda.

If you pay attention, many technology companies and startups that became famous worldwide emerged or scaled during this period. On the other hand, the story of Silicon Valley Bank, which collapsed in America due to the effects of the FED interest rate increases as of the end of 2022, has been negative for technological start-ups to reach investment. Since that period, the amount and number of investments have decreased in the world. By the way learning English is very important for co-founders.

Start-up Ecosystem: Definitions and Key Characteristics

In the start-up ecosystem, which has own terminology, there are too many definitions to fit here. However, knowing the definitions we have listed here will enable you to master the entrepreneurship dictionary at a basic level.

- Founder / Co-founder: These definitions are used for the founders or co-founders of startups, which are new generation technological companies. If you use Linkedin, you will see the phrase “founder” on some people’s profiles. This phrase means that the person is the founder or current boss of the relevant company.

- Angel Investor: These types of investors are individual investors, not corporate investors, and they invest in many startups in small pieces. If even one of them achieves the expected growth, it will bring a lot of profit to the angel investor.

- VCs: They are Risk or Venture Capital institutions. Unlike angel investors, these are corporate organizations, not individuals. In line with that they invest larger amounts in start-up companies that they see potential in, after very strict screening and questionnaire processes.

- Acceleration Programs: Acceleration programs, which have become very popular among large holdings and banks lately, generally include new generation technological startups that are at the initial stage into 6-month programs. They aim to grow them, that is, accelerate them, by providing them with mentoring and various trainings, and graduate them from their programs.

- MVP (Minimum Viable Product): In start-up ecosystem, the phrase of “If a product is completely perfect, it is too late.” is common. So, by the time you code the application or get the website ready, someone else has already implemented that idea. That’s why you are expected to implement and launch your minimally functional application into the market. You will compensate for your shortcomings over time with feedback from users. We call this minimum viable product or product MVP.

Other Basic Definitions

- Crowd-funding Platforms: Let’s say you are a real person and you want to contribute to start-ups by investing in them and make money from their future potential. There are crowdfunding platforms just for small investors like you. Thanks to these platforms, you can invest in many start-ups with very small amounts and become shareholders.

- Incubation Centers: Realizing how important the production and export of high-tech products are, states and universities establish incubation centers and provide offices and various supports to startups in the early stages.

- Shared Office: After all, if you are a newly established start-up, you do not have much capital. Therefore, if you do not have a budget for things such as office rent, electricity and water bills, you can rent an office by paying a much more affordable fixed fee to shared office centers and reduce your expenses in this way.

Start-up World Information

The startup ecosystem in the world has started to lose momentum as of the end of 2022. After the collapse of Silicon Valley Bank, known as the bank of startups, there was a noticeable decrease in investments. Despite this, the largest and most successful start-up ecosystem in the world is still America’s Silicon Valley. It is followed by London in second place and China in third place. America, which has a great advantage in terms of incubation centers, acceleration programs and access to capital, is followed by New York, London and China, respectively.