Contents

In countries where financial literacy is not high, people generally feel the need to do research before taking out a loan. In other words, since they do not know the basics of the subject very well, the process of taking out a loan seems complicated to them. The first thing that comes to their mind is what kind of loan they should take out and differences between Personal vs Business Loan. On the other hand, before going into this subject in detail, it should be noted that; after all, the word loan is derived from the word “trust”.

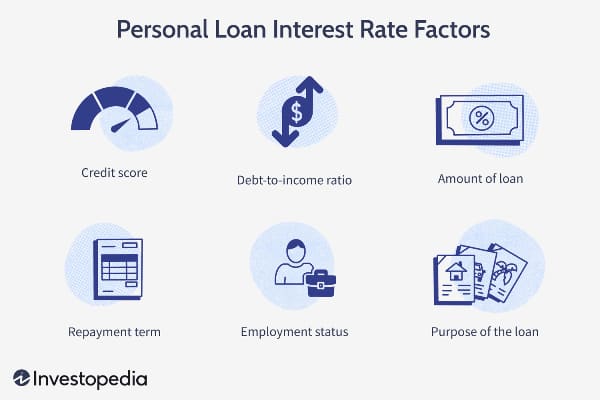

In this sense, trust means credit score in today’s financial world. Keeping this score, high is the most important financial duty of all of us. Before the types, definitions or differences of loans, it is necessary to know that it is a matter of trust and act accordingly. In this context, we will try to provide detailed information on this subject, the distinction of which is generally not fully known globally, in our article.

Personal vs business loan have their own characteristics, advantages and disadvantages. The probability of getting a loan that is applied for and documented according to the right need is very high. As long as we truly know our purpose and where we will use the money and transfer it to the other party.

Advantages of Personal Loans

Personal loan is the name of the loan used by person who does not do commercial business as the name suggests, to meet their personal needs. For example, expenses such as vacation, education or renovation are included in the scope of the needs of persons. There may be many personal areas of use included in the scope.

If we list the advantages and disadvantages of personal loans:

– Easy application: It is possible to apply from your salary bank without any documents, only with your ID. It will be sufficient for your credit score to be positive.

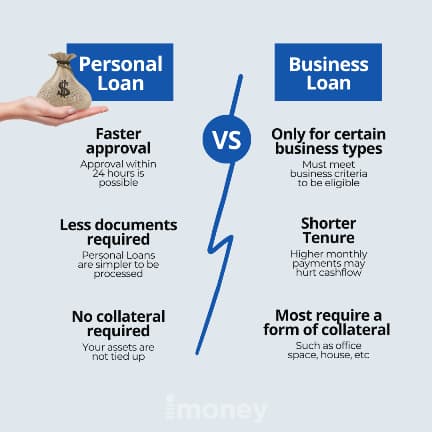

– Fast approval processes: When it comes to the personal vs business loan, the first thing that comes to mind is that the approval periods of personal use consumer loans are much easier and faster than commercial ones.

– Collateral: In commercial loans, the processes are generally long and tiring in terms of collateral. In other words, since the amounts are generally higher, the other party may ask you for collateral such as a house or a car against the credit risk. However, such collateral is generally not requested up to a certain amount on the individual side.

– Fixed Interest Rates: The interest rates of personal loans are fixed generally. In other words, in countries where interest rates are very volatile, this situation ensures that the rates are predictable and the instalments are always the same. In an environment where inflation is so high, fixed instalment payments can also give the feeling that the instalment amounts are decreasing in real terms over time.

– Low Limits and Amounts: The disadvantage we will list is the limit issue. In other words, if you have a high need, it would be appropriate to turn to housing or vehicle loans.

Advantages of Business Loans

Commercial business loans are the type of loans used by companies or tradesmen. It is possible to use these types of loans for working capital, purchasing materials, raw materials and equipment, or other business needs. Although it is not recommended, it is also possible to make some payments that the company needs to make from its regular operating income, such as personnel salary payments, with commercial loans. The review and approval process of such loans, which require documents such as balance sheets, income statements and business plans during the application process, is much longer. Naturally, their limits and terms will also be much longer.

If you have a business or a capital company, it is important to meet your needs with your own capital and equity capital. After all, credit means debt and has a cost. If your own resources are sufficient, it will not make sense to apply to external resources. On the other hand, when it comes to personal vs business loan it is very clear that if you have a job that will earn you more than the cost of the credit and you plan to use this external resource as a profitable leverage, then the situation changes. When we talk about personal vs business loan it is very important to list advantages and disadvantages.

If we list the advantages and disadvantages of commercial loans:

– Higher limits: While the loans to be used by tradesman are proportional to their documented monthly income, this situation becomes more complicated for commercial organizations. Because the amount of loans that businesses can take can be much higher in direct proportion to their future plans and their capacity to increase their production.

– Changeable interest rates: While this situation can be advantageous for companies in periods when interest rates tend to fall, it is disadvantageous for companies in periods when interest rates tend to rise.

Collateral and Tax Issues

– Requesting collateral: We have stated that the amount and limits of commercial loans are higher than individual loans. In this sense, the assets that will constitute the collateral of the credit risk become more important in this sense. In addition to houses, shops, vehicles, checks or promissory notes originating from their trade can also be taken as collateral for companies engaged in trade.

– Tax and Fund Advantage: There is no fund in commercial loans in most countries. In this context, the absence of funds ensures that the interest received from commercial loans is less than other types. In addition, companies can deduct some types of loans from taxes. Financial advisors will provide the most accurate information on this subject.

Differences: Personal vs Business

When we are talking about the differences between personal vs business loan and trying to understand which one is right for you, there are two important issues that you need to put at the core of the issue. These are: “Is my need individual or not”, that is, whether you have a commercial activity about that credit. In other words, the financial institution or bank that gives the loan will not give a commercial loan if your need is individual. In this sense, it is very important to determine your need firstly.

On the other hand, if you are already a company or a tradesman and your need is commercial, you will need to use a commercial loan. In addition, in these types of loans, you should use them for investment purposes in terms of at least 36 months or more. Otherwise, you will make the mistake of financing long-term investments with short-term loans, which will seriously shake your financial structure.

At this point, it is necessary to list and summarize the basic differences between personal vs business loan:

– Purpose: As we mentioned before, if place and purpose of the loan is personal such as school, simple consumer needs, vacation or daily expenses, personal loans will come into play, and other types of commercial loans will come into play.

– Interest rates: While the interest rates are fixed when using personal loans in general, they can be variable in loans that finance commerce. This situation also creates an important difference depending on the place.

– Maturities: Since commercial loans finance longer projects or jobs, they are basically longer-term loans. In this sense, consumer loans are often limited to one year. Of course, another important issue here is the requirement to be proportional to the person’s income.