Contents

There are many critical issues that people forget to focus on in daily life. Some of these issues are unimportant to them. Some are actually important, but people cannot grasp the importance of these issues. Personal finance management is one of these issues. In fact, such an important issue that should be taught to all of us starting from primary school is often oversimplified or ignored. This issue, which has the potential to lead to bad outcomes such as people getting into excessive debt and even getting depressed because of debt spiral, is actually an issue that we all need to focus on from a basic level to an advanced level. By the way you first read financial literacy article.

If we consider the issue from a social perspective, if there is a problem of individuals not being able to balance their income and expenses and getting into excessive debt in societies with low financial literacy, this situation will even lead to serious social and sociological consequences. At this point, everyone has some personal responsibilities. While the incomes of individuals in developed countries are relatively high, if we live in a developing country, we need to improve ourselves in the individual management of basic economic issues such as budget, expenditure balance and savings.

Our basic topics on Personal Finance Management will be as follows:

- Income-Expenditure Balance and Budgeting, that is, knowing and creating a budget.

- The best free budgeting programs

- Income management and savings. Expense management and cutting expenses

- Investing with savings (if possible)

- Setting financial or economic goals

- Developing financial literacy

Now, if you want, let’s make some basic explanations about these topics that everyone can understand.

What Is Personal Finance Management?

• Income-Expenditure Balance and Budgeting: You must have witnessed budget discussions in the parliaments in certain periods in the news wherever you live in the world. States prepare a budget for the next year, where they plan their income and expenses at least once a year. A budget is a law for states and is related to the next year. If there is excess money in the budget after expenses are deducted from planned income, this means savings.

These savings are also evaluated by making investments and an attempt is made to create additional income. Just like states, individuals also have a budget. On the other hand, most people spend unplanned without thinking that they actually have a budget. Now let’s look at the simple definition of a budget.

According to dictionaries, a budget is a chart showing and planning future income and expenses for a state, family or person. However, a budget is very important for financial health and stability. Yes, if you are reading this article, you should now make a budget “every month”. For example, let’s say you have a fixed salary every month. Let’s allocate 80 percent of this monthly income to spending every month.

Let’s aim to save the remaining 20 percent. Let this be our goal. Then let’s track whether we achieved the goal at the end of the month. For now, let’s state that keeping a monthly budget is very important in personal finance management. In the past, our elders would write their monthly income and expenses in notebooks like grocery ledgers.

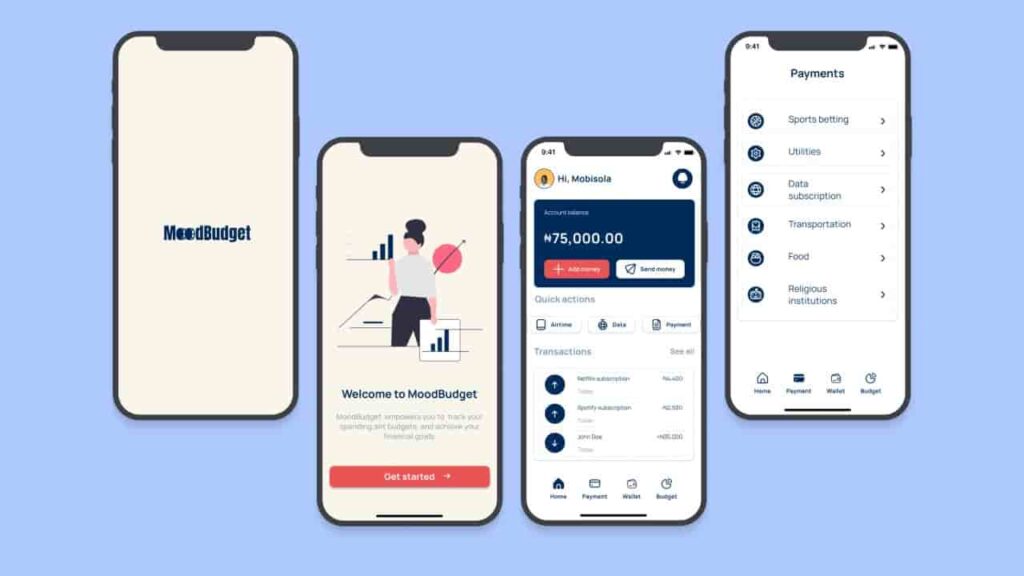

Let’s keep an excel file as the simplest. However, if we remember that we are now in the digital age, we would like to remind you that there are very good budget tracking applications or apps for both Android and IOS.

Why Is Managing Your Finances Important?

- Income Management and savings: We are aware that if you are working with a fixed salary, your income is limited. On the other hand, let us state that economics is an effort to increase our welfare by effectively managing limited resources.

In other words, since our income is fixed and we cannot increase it, we should reduce our expenses in order to have a budget surplus. We are aware that you get angry when we talk about cutting expenses or expenses. We also know the question, “Well, I already spend very little, what else should I cut?”

However, even if we reduce our monthly expenses by 10 percent per month, we will reach a serious number annually. The most important known method for reducing expenses is to divide your expenses into categories. Here, we need to make a clear distinction between needs and ambitions in order to provide better personal finance management.

If you categorize your expenses as:

- 1- Mandatory-Basic Expenses

- 2- Desires

- 3- Savings

and write each of your expenses next to these three basic categories, you will see that there is still room for saving.

At this point, let’s list some expenses that include personal desires and ambitions, in case it helps you.

- Frequent weekend breakfasts or dinners outside

- Daily alcohol consumption

- Smoking expenses

- Monthly digital subscriptions

- Coffees bought “every day” from big coffee chain brands.

- Excessive taxi use

- Sudden and unnecessary online shopping

- Relatively more expensive products purchased due to brand obsession.

You can add items to this list as per your own. Remember, our aim here is not to eliminate all the items above from your life.

If your income does not cover your expenses and your budget turns negative every month within the framework of personal finance management, you can evaluate these items.

The Role of Financial Education in Personal Finance

- Turning Your Savings into Investments: If you have read this far, it means that you have some savings, even if they are small, and our aim is obviously to increase these savings by making investments. First of all, we recommend that you research portfolio management companies on the internet regarding managing savings. These companies open an account in your name and invest your monthly savings in risk appetite-based investment instruments such as term accounts, gold, stock exchanges, treasury bonds, Eurobonds, real estate funds or government bonds through their experts, providing you with certain rates of return. This is very important in personal finance management topic.

What is important here is to create a savings culture. The Japanese are a well-known example at this point. In Japan, people’s savings rates are 40 percent and even 50 percent at certain periods. This makes great contributions to their development and financial stability by making investments both individually and as a country. Your basic approach to savings and investments should be that you will gain serious savings at the end of the period when you take even the smallest amounts seriously and constantly put them aside.

- Setting financial and economic goals: Our main starting point in this title is the fact that people lose motivation when they are goalless. For example, when you start a diet, if you do not set a certain weight loss goal for yourself at the end of the period, you will see that you have given up the diet after a few days. At this point, you should also set monthly or six-month goals for yourself regarding personal finance management. You should also track your progress towards these goals monthly. First of all, do not forget to set SMART, reachable, measurable and realistic goals when determining your goals.

Tools and Resources to Help Manage Your Money

Imaginary and exaggerated financial goals will deter you from your path in a short time. For example, putting aside one hundred dollars every month and aiming to buy a lux car with the investments you made with this savings at the end of the year will be exaggerated.

- Improving Financial Literacy: This heading is actually a goal. On the other hand, as in the goals in other articles, we are not talking about monetary or numerical goals in this heading. Our aim here is to be an individual who is well-versed in financial matters in the medium and long term and has reached at least an intermediate level in investment and savings. We recommend that you follow some columns or digital channels on this subject on a daily basis.

While you are investing, what is happening in your country and in the world will affect your investments. In this sense, investors who are both financially literate and know the meaning of basic economic indicators and take positions accordingly will always have an advantage over others.

Finally, when it comes to personal finance management, the first thing that comes to mind is creating an individual budget. In this budget, where future income and expenses are planned, there should be a savings plan of at least 15-20 percent. Using mobile applications and reminders to follow these will also increase our motivation. Afterwards, the most rational method is to entrust the savings to professional investment companies.

Budgeting Apps List and Your Financial Success

However, setting personal financial goals and increasing financial literacy through gradual training or personal efforts between periods will complete our individual steps in financial management as a whole. By the way knowing when interest rate will go down is also important in this concept.

We have just mentioned how useful budgeting programs are. In this concept, if we were to make a list of the best budgeting apps for 2024, it would be as follows:

- GoodBudget

- EveryDollar

- YNAB

- PocketGuard

- CountAbout