Contents

It is a phenomenon or a trouble that we see everywhere, on television, on the street, in newspapers, in the grocery store and even if we do not see it, we actually experience it with the blood in our veins. Yes, we are talking about “Inflation”. Actually, it is a concept that people who were born in developing countries the second half of the 80s often heard during their childhood. However, due to the high price increase process we have experienced in the last 2 years, especially in the post-COVID-19 period, the concept of price increase pressure has become a popular agenda topic for everyone almost worldwide.

In this context, we will focus on the issue of inflation in many aspects in this article both because it is a subject that is likely to come up in job interviews on the career path and to contribute to our personal development.

We will approach questions about price increase process without drowning in technical terms, that is, in a way that can be understood not only by people who have studied economics but also by people on the street who do their daily shopping in the market, greengrocer and we will try to find answers. In this context, this issue is important for both career development and personal development.

The information you will learn here and this subject will help you in every aspect of your life, especially the economy.

What Is Inflation? Everything You Need to Know

When you type and ask search engines the definition, you will come across answers such as “Inflation is continuous increases in the general level of prices.” This definition expresses the technical and scientific dimension of the subject. However, what we all feel at the supermarket or butcher is that the money in our pocket is melting and losing its value. In this context, inflation in its simplest sense is the melting of the money in our pockets and losing its value. Please read the rest of our article for a better understanding.

We will also share with you a short CPI video below our article, which we believe is one of the best videos about the subject. By the way you should know how fight inflation also.

On the other hand, in the news generally, when they are talking about inflationary process, they mean and use “Inflation rate“ as an important economic indicator. In the light of this information, first of all, let us state that when we say CPI rate, we should think of two types of rates as: “monthly” and “annual“. Monthly CPI rate expresses the increase in the general level of prices in that month, from the beginning to the end of the month.

Furthermore, the annual rate expresses the increase in the general level of prices since the same date exactly one year ago until today. For example, if we were to express it in accordance with our initial definition let’s say the monthly CPI rate is announced as 2 percent. According to our simple definition, we can say that our money has melted or lost value by 2 percent that month. Or, when the annual inflation rate is 70 percent, we may think that the money in our pockets has melted by 70 percent in the last year.

How Inflation Affects the Economy and Calculation

When we talk about inflation figures, what we should think of is actually no different from the rate. When we hear the phrase inflationary figures, we may think of monthly CPI (Consumer Price Index) rate or annual rate. As we mentioned before, we do not use the term price increase figures as a technical term in the grocery store, butcher or market. However, it is these CPI figures that actually burn our pockets and melt our money.

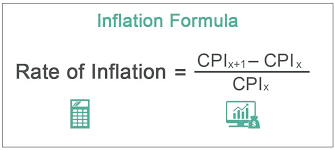

When it comes to Inflation Calculation, we would like to explain it to you with simple logic, without going into technical details and formulas. Statistical Institutions announce CPI figures in countries every month. In this context, the monthly inflationary rate is the ratio of monthly changes in the CPI, which is the Consumer Price Index announced by official institutions every month. Calculating annual CPI is the same. In other words, the ratio of the announced annual CPI figures to each other constitutes the annual inflation rate calculation.

Inflation Expectations

The subject of inflationary expectations has become popular in the academic field, especially in the last 20 years. Especially since the early 2000s, the spread of the internet and the faster movement of information have made the issue of “managing the expectations of people and societies” very important. In this context, it has become possible for central banks almost all over the world to manage expectations with their transparency and consistent statements. In this way, it has become easier for central banks to influence many economic data.

It should be noted at this point that; for example the difference between the price increase expectations announced by the American FED and the actual CPI rates has been reduced to a minimum due to fact that American FED manages the expectations correctly. On the contrary, in countries that cannot follow consistent and rational monetary policies, there may be serious differences between the price targets announced by the central banks and the CPI rate realized at the end of the year. When these differences, which can also be called inflation difference, arise, wage earners and retirees, whose salary increases depend on these differences, will demand the salary increase from political governments.

Causes of Inflation: Demand-Pull vs. Cost-Push

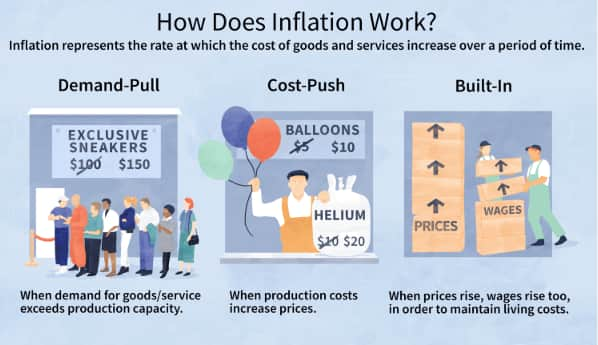

Here, we would like to give information about the types of inflation in the shortest and most concise manner, without overwhelming you with technical terms. It is divided into two main types according to its cause, that is, its source and its severity.

We can express the types of inflationist process as follows;

According to their causes:

1-Demand Pull type of price increase:

This type occurs when the total demand created by people in a country exceeds the total production of companies, that is, the supply. For example, let’s imagine that the government suddenly doubles the minimum wage.

Since production will be constant in the short term, the high demand for products by people with increasing income will increase prices and cause demand type of it.

2- Cost Push type:

The reflection of the continuous increase in production costs on prices as a result of the increase in the prices of goods and services used by companies in production also constitutes “cost push inflation”. An example of this is the increase in the dollar exchange rate and companies using foreign inputs to produce.

3- Built in Inflation:

It is the worsening of expectations in a country due to the constant increase in prices and the expectation that prices will continue to increase in the future, causing inflation. It is seen in countries that are in a spiral of wage price increases and also shows the importance of expectation management.

According to their severity:

- A) Moderate/Mild Inflation: It is the type that is not severe and a little bit is required for every country. 🙂 It is a harmless type and its rate varies from country to country.

- B) Galloping Inflation: Inflationary process that distorts income distribution and negatively affects the healthy allocation of resources is galloping inflation. Because it is severe and continuous, it completely melts the value of money and makes it worthless.

- C) Hyperinflation: The phenomenon of hyper-price increase, which is known to have occurred in Germany during World War II, causes money to lose almost all its functions. In addition, during periods of hyper type, a destructive process usually occurs in that country, which may lead to the use of foreign currency instead of domestic currency. This process, encountered during times of war or severe economic crises, is the most destructive and severe type.

The Impact of Inflation on Your Daily Life!

We guess that you were a little surprised while reading this subheading, but at the same time, this subheading caught your attention 🙂 Admit it, it is difficult to find or see the relationship between price increase process and crime rates in the classical and often copy-paste content you come across when you search for the concepts of inflationary rates or types on the internet. 🙂 The most important result of high CPI rate is the devaluation of money, the decrease in the welfare of those working on fixed income and the worsening of their living standards.

Because salaried employees receive their salary increases according to inflation (Consumer Price Index – CPI). In addition, high CPI, which disrupts income distribution, also negatively affects the healthy distribution of resources.

We have stated before that inflation is basically the melting or loss of value of the money. International scientific research conducted in this context shows that; in countries – underdeveloped or developing – where the price increase rate is high and experiencing chronic high prices, crime rates tend to increase in parallel.

Again, research shows that; people become more prone to commit crimes as their financial situation deteriorates and their income falls below a certain level.

It should be noted at this point that; there is a very serious and solid relationship between economic developments, the country’s social structure and social behaviour. It should be clearly stated here that people whose economic situation deteriorates are at risk of committing crimes, especially when their income falls below the level that meets their basic human needs.

In conclude, especially in developing countries, there are serious increases in crime rates during periods of high or hyperinflation. States and governments that want to reduce crime rates and repair the structure of society should also take economic indicators like CPI into account.

How to Solve Inflation Problem?

The first place to look at the solution to the problem is the source of the inflationary process. So, is CPI type demand-pull, cost-push or built in type? As a solution to demand pull price increase process, it will be necessary to reduce total demand, that is, reduce people’s disposable income or loans. At this point, the first thing done in the classical economics literature is “increasing interest rates”. As it is known, during inflationist period experienced almost all over the world, especially in the USA and Europe, after the COVID-19 pandemic, countries have resorted to reducing total demand by increasing interest rates.

We discussed this topic in our article named “Why did the FED Increase Interest Rates?“

On the other hand, if we are faced with cost push type, it will be necessary to examine the cost items. For example, if foreign currency accounts for majority among the cost items, it will be necessary to take measures to prevent the increase in foreign currency. Here, it is important to try to reduce costs by reducing the current exchange rate by increasing interest rates and attracting foreign currency to the country.

Apart from these two situations, the reason for high prices in the country may be complex. In other words, if there is some demand type and some cost inflation, things will become a little more difficult. Because when we increase interest rates to reduce demand, if the cause of cost inflationist pressure is interest expenses, with this move we can cause increase cost price increasing process while reducing demand type. As we can see from here, goals in the economy can sometimes contradict each other.

In these mixed cases, economic management should take necessary measures step by step in a measured manner.