Contents

In today’s world where inflation is high and carrying money is quite costly, the importance of credit cards is increasing. In this context, in an environment where the world is becoming increasingly digital, carrying cash has become completely out of fashion with the increasing popularity of digital or cryptocurrencies and Bitcoin. Naturally, it should be noted that virtual currencies or cards will become much more common in the future. So, do we really know how to use them? In other words, today, we will seek an answer to the question of “how to use credit cards responsibly and wisely?”

How much do we have an idea about using this financial product, which actually provides us with countless benefits when used correctly? It is obvious that while credit cards are used very frequently and well in societies that are well-versed in personal finance management and have high financial literacy, there is some confusion on this subject, especially in developing societies.

Before we get into the subject, the first thing we need to know is that a credit card provides you with approximately loads of days of free financing if paid on the latest due date. In other words, when you pay for a purchase, you made on the first day of your statement, on the last payment date, you use this financing opportunity without interest.

In this sense, people who do not miss the last payment date are the ones who benefit the most and most correctly from these cards. In other words, instead of demonizing banks, it would be much wiser to increase our financial knowledge and use these products in the best way.

The Place of Credit Cards in Our Daily Lives: Choosing Right Card

Credit cards, as you will appreciate, are the most important tools that facilitate our financial transactions in today’s digital and fast-paced life. From ordinary shopping to travel or travel, from emergency payments to paying regular bills, credit cards touch our lives and make them much easier.

At this point, we must say that answering to the question of how to use credit cards responsibly and wisely will offer financial flexibility and various advantages. However, credit card use is also a matter of caution. Incorrect or excessive use of the card due to not being able to manage our budget correctly can ultimately create uncontrollable debts and financial difficulties.

For this reason, in order to maximize the advantages of using a credit card and minimize its risks, it is necessary to adopt a conscious approach based on financial literacy. In other words, when it comes to how to use credit cards responsibly, we should first focus on this issue.

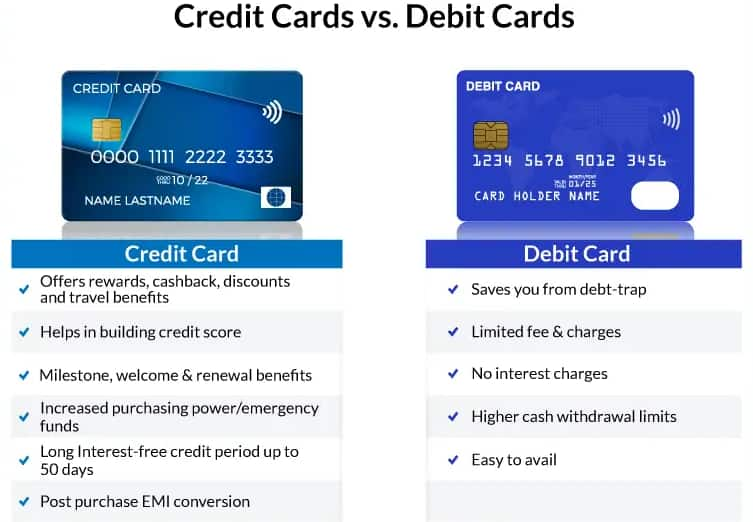

However, these products have many different features that vary according to banks. In other words, choosing the right credit card has a direct impact on your financial preferences and, naturally, your health. One of the most important criteria in choosing a card is low interest rates and appropriate limits according to your income. Since each user’s spending habits are different, it is important to compare the available offers to determine the most suitable credit card for you.

In addition, the additional benefits, points and reward programs offered by the credit card should also be taken into account in the selection. Many banks offer discounts on certain spending items, cash back or points system. These advantages provide additional benefits for those who use credit cards regularly, and can make your financial life easier with the right card selection.

How to Use Credit Cards Responsibly: Debt and Budget Planning

The first thing we need to say in this title is that the card is a debt. In other words, the limit provided by the credit card is not your money. In other words, this limit is actually a debt. The first thing that should come to mind about how to use credit cards responsibly or wisely is that we actually get into debt the moment we use the card. If we keep this in mind, we will avoid uncontrolled and high spending.

At this point, we need to state that; When using a credit card, it is very important to follow your spending regularly, if possible monthly or weekly, in order to keep your debts under control. In other words, by dividing your weekly or monthly spending into certain categories and including these expenses in your budget, you can analyse in which areas you can save. This approach prevents unnecessary spending, allows you to know where and how much you spend, and allows you to see your financial situation clearly.

In addition, it is necessary to create a regular plan to pay off your credit card debts in direct proportion to your income. It is clear that paying more than the minimum payment amount helps you get rid of the interest burden. Paying off your debts early and keeping your budget under strict control plays a major role in achieving financial freedom in the long term.

In relation to this, developing rational and conscious spending habits is one of the most important factors in using a credit card. Right now, we should underline that; distinguishing your needs and desires and avoiding unnecessary expenses will help you maintain financial balance. Naturally, planned and regular spending will keep credit card debts under control and prevent future financial difficulties.

Saving is an Important Issue in Debt Management

On the other hand, when talking about how to use credit cards responsibly, it is important not to forget the awareness of saving. In other words, it is also important to integrate saving methods into your life. Allocating a certain amount to savings every month will help you be prepared for emergencies. This habit will strengthen your financial health beyond credit card debts and protect you against unexpected expenses.

Benefits of Responsible and Wise Usage of Them

As we have stated before, credit cards, which are actually a borrowing limit granted to you, do not cost you interest if you pay on time. In fact, when you use it on the first day and pay your debt on the last payment date, it provides loads of days of end-to-end financing. These days is also a very long period in inflationary periods. Some companies provide instalment opportunities for such cards. In fact, some companies make credit card use quite advantageous by offering interest-free instalment campaigns at cash price.

In this way, while the card itself sells more products and services, it also provides a great advantage to the card user. In addition, there may be financial institutions, banks or fintechs that give plus points or gifts due to card use.

In conclusion, we need to state that; the subject of “how to use credit cards responsibly”, not only prevents debt; it also improves your financial management skills. In addition; correct usage strategies allow you to fully benefit from the advantages offered by credit cards. This way, you can have financial flexibility for emergencies and large purchases.

Please remember that one of the keys to financial freedom and a regular budget is being able to use your credit card wisely and responsibly. As you can appreciate, with rational and conscious use, you can protect yourself from future financial risks and build a healthy credit history. Ultimately, taking the right steps in using your credit card will provide financial stability and security in the long run.

Advantages of Using a Credit Card Wisely

For those who do not want to lower their credit score due to incorrect use of their credit card, we would like to list the advantages of using a credit card in bullet points.

Here are these advantages:

- Real Financial Flexibility: A credit card offers opportunity to make instant payments in emergencies or unexpected expenses. For example, if you encounter a sudden health expense, you can solve the problem immediately by paying with your credit card instead of cash.

- Additional Gift Points and Reward Programs: Many credit cards offer advantages such as points, discounts or cash back depending on your expenses. The points you accumulate during your grocery shopping can be used to purchase discounted products in the future.

- Secure Payment Method: Compared to carrying cash, credit cards can be cancelled when lost or stolen, reducing fraud risks. When you lose your card, you can immediately contact your bank to block your card. This is one of the most important topics about how to use credit cards responsibly.

- Creating Credit History and Score: Using a credit card helps you create a positive credit history when regular payments are made. By paying your card debts on time, you can get credit with more advantageous terms in your future credit applications.

- Cash Price Instalments and Flexible Payment Options: You can pay your big expenses more easily and in a way that suits your budget thanks to the instalment option. When purchasing a high-cost electronic device, you can make a purchase without straining your budget by dividing payment into months.

- Detailed Weekly or Monthly Spending Tracking: Thanks to your card statement, you can see your monthly expenses in detail and manage your budget better. The details on the bill you receive each month help you determine where you are spending more.