Contents

With the increase in technology and e-commerce after the pandemic period, we all started to look for answers to the question of whether it is possible to make money by trading online. In this context, it is clear that it is necessary to establish a company first. In other words, since it is not possible to trade without a tax certificate, it is important to know how to register a sole proprietorship. At this point, we should state that you should not enter the path of becoming a sole proprietor without doing some research. Please do not forget that these are serious businesses. 😊

In this comprehensive article, we have brought together information that can guide you in order to help you with your research. After all, after the DeepSeek and e-commerce revolutions, wouldn’t it be bad if we all became our own bosses?

From the most basic perspective, a sole proprietorship is one of the most popular business models established by a single sole proprietor, low-cost and quickly operational. Now, we will try to explain the basics of the sole proprietorship establishment process to you, all the steps from the necessary documents to official transactions. Our 2025 guide, prepared for both beginner entrepreneurs and those who are considering entering the business world, aims to create a solid foundation for your business idea to come to life.

Establishing your own business as a sole trader provides the advantage of flexible and personal management, as well as increasing your financial freedom. We recommend that you carefully review our guide to learn the processes you need to follow step by step to make a solid start in the business world and to open the doors to a successful business.

What is a Sole Proprietorship and Who is It Suitable For?

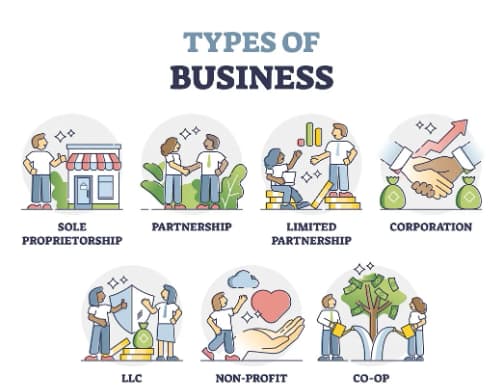

Before answering the question of how to register a sole proprietorship, we need to seek answers to its definition and who it is most suitable for. In this context, we need to state that; a sole proprietorship is a business model established and managed by a single real person, where all responsibility lies with that single real person. This structure is a business model that is preferred for small-scale businesses (SMEs) and freelancers, which we also call tradesmen or those who are just starting out, and is relatively easy to establish and manage.

The business owner is individually responsible for all profits and losses of the company. It is a model recommended especially for businesses that are in the new establishment phase or are not expected to grow rapidly in a short time and receive external investors.

Establishing such companies is low-cost. It also offers the advantage of being established quickly. Official transactions and document preparations are completed more simply and quickly compared to other types of companies. For this reason, it stands out as an ideal option for entrepreneurs or small business owners who will establish a new business. On the other hand, it should be stated that; the biggest disadvantage of a sole trade is that the business owner is personally responsible for all debts and risks of the company.

In other words, when a business gets into financial trouble, personal assets can be at risk. For this reason, it is important to consider the responsibilities that come with this structure when determining your business plan and risk management strategies.

Practical Tips and Common Pitfalls

What we mean is that; although it is easy and fast to establish a sole proprietorship, at the end of the day, all the burden, debt and responsibility are on that single person. Naturally, since it is not possible to take on a partner, if you want to take on a partner or investor in the short term, establishing this type of company will not be for you.

Of course, if you say that you do not want a partner and can easily do the job you have designed in your mind on my own, continue reading our 2025 guide, where we answer the question of how to register a sole proprietorship.

Establishing as a Sole Trader? Required Documents

Financial advisors will give you the fastest and easiest information on this subject. Our suggestion to you is that if you have established your business model in your mind and have now decided to establish a sole proprietorship, first of all, you should make an agreement with a financial advisor. Be sure that you will need the guidance and information of a financial advisor in every step from the establishment to the advanced stages.

We recommend that do not to avoid money in this regard. In other words, although working with a quality and good financial advisor may seem expensive to you in the short term, it is possible to see the benefits of this especially in banks and commercial credit relations. During the sole proprietorship establishment process, basic documents such as an ID photocopy, tax number and residence document are first prepared. Taxing is very important for the topic of how to register a sole proprietorship.

These documents are necessary for the company to be registered in official records. It is critical for your documents to be up-to-date and complete for the transactions to proceed smoothly.

In the second stage, you need to register your company by applying to the chamber of commerce or the relevant official institution you are affiliated with. Preparation of notarized signature circulars and registration in the trade registry are among the official transactions. These steps ensure that your company operates on a legal basis.

In addition, registering with the tax office and obtaining a tax identification number specific to your business is an integral part of the setup process. Correct paperwork and complete forms will help your application to be completed quickly. While following official procedures, checking current legislation and getting expert support, when necessary, will ensure that the process goes smoothly.

How to Register a Sole Proprietorship: Steps and Tips

Under this heading, we aim to itemize the stages of establishing a sole proprietorship company in detail. In this way, we aim to make this seemingly confusing process more understandable. We would also like to remind you that the first step in the relevant steps is to get consultancy and support from a good financial advisor. In other words, it is very useful to meet with an advisor even when you are thinking about how to register a sole proprietorship.

- 1. Determining the Business Idea: Before starting the business, decide in which field you will provide service or sell products. For example, you can turn the idea of selling handmade jewellery you make at home or cookies you prepare with special recipes over the internet via e-commerce into a business idea.

- 2. Preparing a Business Plan: Detail how you will implement your business idea, your target audience, costs and marketing strategies. For example, create a plan that includes how you will reach your target audience by marketing on social media, and your cost and income estimates.

- 3. Preparing the Required Documents: Obtain basic documents such as a photocopy of your ID, tax number, and residence document. Put your documents in an organized folder and make them ready to use in your notary and official institution applications.

- 4. Notary Procedures: Prepare the company’s articles of association and signature circulars and have them notarized. Going to a notary office closest to your office or shop and having your documents approved will help the process proceed officially and smoothly. Notary process is also important for the subject of how to register a sole proprietorship.

Registration in the Trade and Tax Office

- 5. Registration in the Trade Registry: This stage is generally ignored or skipped by real persons. However, if you are going to do long-term and quality work, please do not forget to register with the chamber of commerce or the trade registry that is relevant to you. Officially register your company by applying to the trade registry with the documents you have prepared. Remember that; going to the chamber of commerce in your province and registering your company will ensure that your business operates on legal grounds.

- 6. Registration in the Tax Office: Get a tax number for your company and register with the tax office you are affiliated with. It is very important for the subject of how to register a sole proprietorship.

- 7. Opening a Bank Account: Open a bank account in the name of your company to easily manage the financial transactions of your business. For example, in order to track your business income and expenses, open an account at a bank suitable for you and manage all financial transactions from there.

Taxation and Financial Management Process

One of the most important issues to consider when doing business or establishing a company is finance and taxation. In other words, if you do not know how much of the goods or services you sell you need to pay to the state as tax or the differences between personal and business loans, then there is a problem. In other words, after the establishment of a sole proprietorship, it is necessary to focus on tax liabilities and financial management processes. Ensuring the income-expense balance of your business, keeping regular accounting records and submitting tax returns on time are essential for sustainable business management. Compliance with tax legislation is the main key to avoiding possible penalties.

On the other hand, in financial management, it is important to regularly monitor cash flow and make budget planning. Preparing monthly and annual financial reports to protect the financial health of your business allows you to objectively evaluate your performance. Accounting software and professional support provide great convenience in managing complex financial transactions. Remember, even if you are very profitable, if you do not manage your cash flow correctly, you will face the risk of bankruptcy at any time. History has seen very profitable companies that went bankrupt or closed down in this way. One of our most basic answers to the question of how to register a sole proprietorship is “knowing finance and taxes well.”

Finally, it should be noted that; it is necessary to analyse the tax advantages and deduction opportunities in sole proprietorships well. By working with tax consultants and financial advisors, you can both benefit from legal advantages and avoid unnecessary costs. Regular financial audits and planned budget management will contribute to your company’s long-term success. In addition, we recommend that you examine state incentives and special public credit campaigns.