Contents

We have previously explained in detail in our relevant article that a continuous increase in the general level of prices means inflation. We even stated that a continuous increase in the prices of “some” products or a “one-time” increase in the prices of all products and services would mean a price increase, not inflation. After repeating this information, we must emphasize that constant increase in prices will disrupt income distribution and eventually even affect social justice. It should also be noted that this may eventually lead to social explosions. In this sense, the fight inflation gained great importance throughout Europe, especially after World War II.

In this context, we would like to remind you of the example of Germany that is always given. It is said that due to the hyperinflation experienced in Germany during World War II, soldiers smoked tobacco by wrapping it in money instead of paper.

At that time, money became so worthless that soldiers no longer saw any harm in smoking tobacco by wrapping it in it.

So much so that European countries, especially Germany, are still very afraid of inflation and its negative consequences and always prioritize the combat against it. On the other hand, it should be noted that economic policies should be used in harmony to fight inflation. In other words, monetary and fiscal policies should move simultaneously and in the same direction, just like harmonious parts of an orchestra. Otherwise, problems experienced in some developing countries will occur.

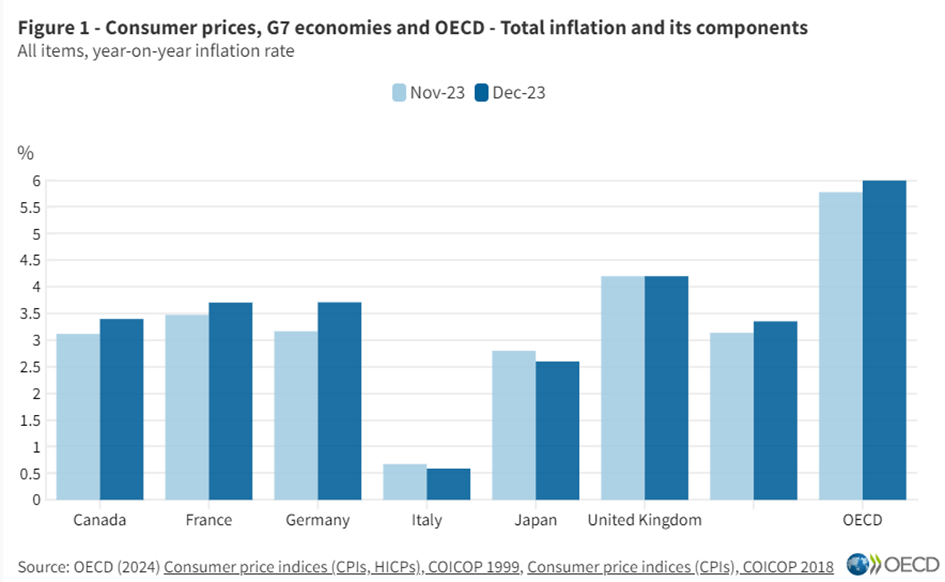

According to OECD sources, the inflation rates of G7 countries and the OECD inflation average are given in Figure-1 above.

In this context, we see that powerful and big countries are in a better situation than the average OECD countries.

What Is Inflation and Why Does It Happen?

As it is known, supply chains that were broken after the pandemic still cannot function properly. Moreover, the serious global rise in commodity prices recently such as oil, wheat and cotton has also made access to agricultural and food products difficult. In addition to all this, rapid increases in logistics costs continue to put upward pressure on prices despite all the measures taken. At this point, the issue of fight inflation becomes much more important. In this context, if you follow world public opinion and politics, you may be seeing the protests of farmers in Europe and America these days.

Almost all over the world, farmers are protesting against their own governments due to rising costs and the difficulty of competing with imported products. These protests are just a small example of the events related to the social explosion we mentioned above.

In other words, if you do not fight inflation or fail to achieve sufficient success in your efforts, income justice will deteriorate over time. Thus, the phenomenon of inflation, which negatively affects the correct allocation of resources, will also damage social justice after disrupting income justice. On the other hand, the continuous increase in the general level of prices will not only disrupt the correct allocation of resources, income and social justice, but will also negatively affect people’s expectations.

Feelings of “inertia, laziness”, also known as “inflation inertia” will prevail in people in an environment where prices are constantly rising, and sellers will continue to increase their prices. We also need to look at this situation from the buyers’ side, that is, from the demand side.

Under these conditions, people who think that prices will increase further in the future will want to consume all their income today instead of saving.

Demand and Cost

This situation will fuel demand inflation and this cycle will feed on each other and move towards an inextricable phenomenon of hyperinflation. When people whose expectations are deteriorated expect higher price increases in the future and turn to consumption instead of savings, the savings necessary for economic growth will not be able to be achieved domestically. In this case, foreign savings will be provided from abroad at high cost. This will further disrupt the economy. In line with that fighting the constant increase in the general level of prices is such an important phenomenon.

As a result of this phenomenon, people may experience great poverty and politicians may have to pay a high price.

How Governments Fight Inflation: An Overview

After briefly stating what inflation is and how important it is to combat its harms, let’s now briefly explain the ways to fight it. If the constant increase in the general level of prices we are experiencing is due to “increase in demand”, we must first reduce the demand.

On the other hand, if this situation is due to a decrease in supply due to the increase in “input costs”, it is necessary to take measures to support the supply.

In this context, politicians governing countries have two policies in their hands to affect basic economic indicators.

These are;

- Fiscal Policy

- Money Politics

While the fiscal policies of countries are generally carried out by finance ministers appointed by politicians, monetary policies are carried out by Central Banks.

“Tight monetary and fiscal policy” should be implemented within the scope of fight inflation.

Monetary Policy

a– ) At this point, the measures to be taken during tight monetary policy are:

– Interest rates hikes: As a result, people save their money by depositing it in the bank with higher interest rates instead of spending. As a result, spending falls and demand inflation decreases.

– Required Reserves Increase: Banks cannot distribute all the money they hold as deposits as loans. They have to keep a part called required reserve in the central bank. If the Central Bank increases this rate, the amount of money that banks will lend will decrease and then total loans and then expenditures and total demand will decrease.

– Open Market Operations: The Central Bank collects money from the market through open market operations and issues government securities in return. Thus, as the money available to spend in the market will decrease, total demand and consumption will also decrease.

Fiscal Policy

b- ) The measures that can be taken within the scope of fight inflation with a tight fiscal policy are:

– Public Expenditures Reduce: In this way, the state’s budget deficit is reduced and the printing of money is prevented. Do not forget that when the government prints money, the amount of money becomes abundant and naturally the value of money decreases. This situation will also trigger consumption and cause inflation.

– Tax Rate Increase: When tax rates increase, demand inflation will be reduced as the money available for consumption in people’s pockets will decrease.

The Impact of Inflation on Everyday Life

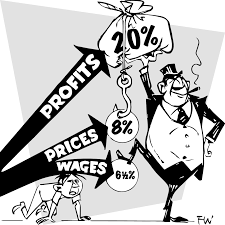

Actually, so far we have talked a little theoretically about the fight inflation. In this part, we will tell you some painful truths. Yes, as every economist knows, there are some contradictions between the aims of economics. So, if you are a politician and you want to win the elections, you will get more votes by reducing the interest rates, increasing the demand and spending. Of course, you can also do this by increasing the emission volume, that is, by printing money. But in this case, “the fight inflation” will be damaged and prices will skyrocket after a short time.

Consequently, you win the election and after the election you have to implement contractionary monetary and fiscal policies, also known as a bitter prescription. As a result of these policies, unemployment will increase and a serious price will be paid. This is one of the dilemmas of economics. That is, there may be conflict between policies and the policy-maker must choose and use the most appropriate policy tools according to the current situation. At this point, it is clear that in order to fight inflation, the rulers of the country and the people must act together by reaching a common social consensus.

In other words, this combat has a cost and neither the rulers of the country nor the people alone should pay it alone. If the politicians and the people pay this cost together, success will come and long-term price stability will be achieved in that country. On the contrary, placing this cost only on the ordinary people or only on politicians, as is the case in some developing countries, will magnify the problems.

Countries List Fight Inflation

Finally, we would like to share with you below the list of the top 10 countries with the highest inflation as of the end of 2023, according to World Bank data.

- Zimbabwe – 285%

- Venezuela – 210%

- Sudan – 155%

- Argentina – 72%

- Turkey – 64%

- Sri Lanka – 48%

- Suriname – 47%

- Yemen – 43%

- Iran – 39%

- Ethiopia – 33%

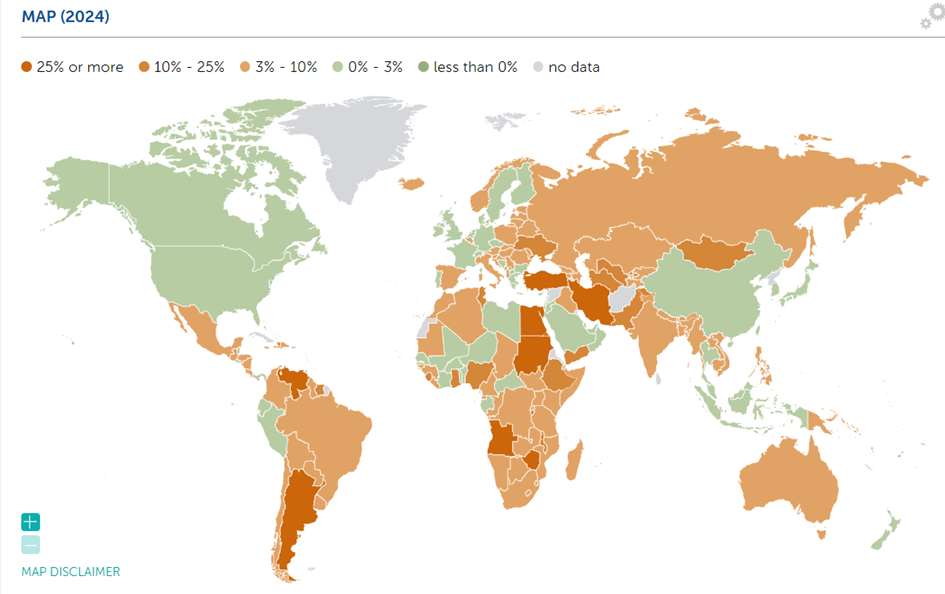

In addition, the world map created by the IMF according to the current inflation situation is below. In this context, countries with an annual rate of 25% and above are marked in orange, countries with an annual rate between 3% and 10% are marked in yellow, and countries with an annual rate between 0% and 3% are marked in gray.