Contents

In America, the world’s largest economy, interest rates have been increased by the FED/American Central Bank for a while. Due to the impacts of this increases in interest rates, it is obvious that whole world have followed these interest rate developments in USA. If we take into account that the American economy constitutes approximately 25% of the whole world economy, we can better understand the importance of these increases. At this point, there are some questions to answer such about why FED increased interest rate and when will start FED interest rate cuts again and how many decreases will be in 2024?

We are looking for answers to these questions in a language that anyone who has not studied economics but wants to pursue a career could understand. Moreover, if we give answers to these questions, we will have a better understanding of why the Federal Reserve increased interest rates and what kind of monetary policy it will follow in the future. In line with that when it will decrease interest rate again and how many cuts will be issues are also important.

Reasons for Interest Hikes

First of all, we should know that America Central Bank FED gradually increased interest rates to reduce and control high inflation which became a serious problem after the pandemic. To give details, the sudden increase in consumer demand which was postponed during the pandemic period, triggered inflation. In addition, at the same time inflation increased due to the decrease in supply in production because of the problems experienced in the supply chains after the pandemic period. Frankly, we could say that; Federal Reserve has largely achieved its goal which was to decrease inflation. As it is obvious, central banks around the world have basic duties such as ensuring price stability and financial stability in general. The US Federal Reserve also has an additional duty to support the labor market. The Fed, headed by Jerome Powell, uses monetary policy tools to accomplish these tasks.

- Money Supply/Printing Money

- Understand the relationship between inflation and interest rate

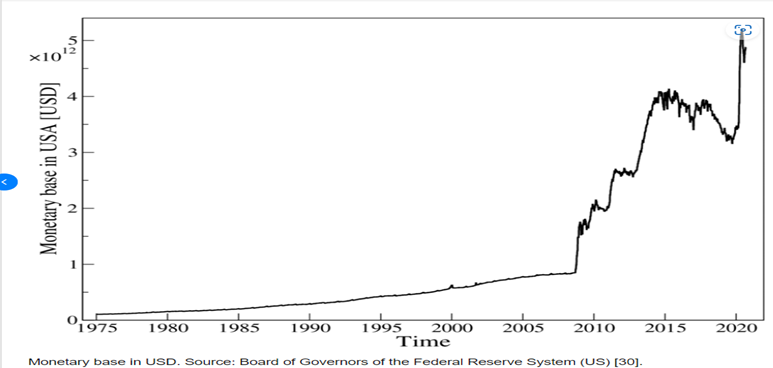

Returning to our subject, it is necessary to analyse two issues in order to understand the real causes of Fed’s interest rate hike. The first of these is the Money Supply, that is, the monetary base (money printing) and the second is the relationship between interest and inflation. We will explain these topics here by supporting them visually with graphics as much as possible.In the chart above, we can see the development of the money supply since 1975. An increase in the money supply basically means that the central bank prints money. If we look at carefully, it will be seen that the money supply remained stable for a long time.

Depression and FED interest rate

Then money supply increased and rose sharply during the 2008 global financial crisis period which started with the collapse of Lehman Brothers. With the start of the crisis in 2008, the FED, who did not want to experience demand shock and depression as in the 1929 Great Depression, started a program called quantitative easing. With this program, money supply increased due to money printing and the government bought private sector debt securities. By taking this action FED gave this money to the private sector, preventing consumer demand from falling, preventing layoffs and the economy from falling into depression. It is obivous that while doing this, FED took the risk of increasing inflation for that period. We are going to “FED interest rate cuts” issue slowly 🙂

COVID Period and Interest

When it comes to 2020, the FED has followed the same path due to the major closures and economic recession due to the COVID-19 pandemic. Jerome Powell and his FED team have rapidly increased the money supply as it is obvious in the graph and taken into account the increase in inflation as the best of the worst for that period.

The second important issue in the interest rate hike of the Federal Reserve, is the relationship between interest rates and inflation. According to the general economic view accepted almost all over the world, the most effective tool in the fight against inflation is interest. When interest rates increase, aggregate demand reduced over diminishing consumer loans (which reduces demand inflation). At the same time, when interest rate has been high, it becomes more reasonable to keep the money as deposits rather than investing it. Moreover, in this concept, since commercial loans will become more expensive for companies when interest rate is high, companies cannot consume by taking loans. Both situations will reduce inflation by reducing consumption and expenditures.

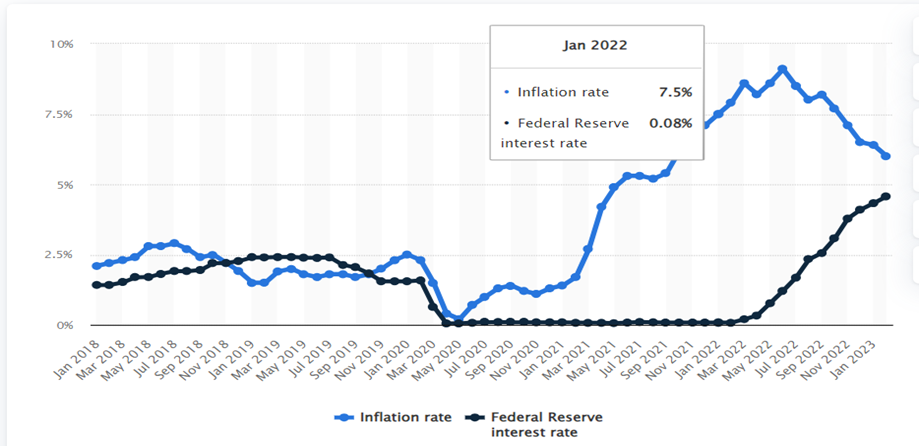

In the above chart, the blue line shows the inflation rate and the black line shows the Fed interest rate. It is clear that with the increase in the interest rate (black line) as of March 2022, the inflation rate (blue line) has been coming down and these two variables have made opposite movements from each other.

When Interest Rate Cuts?

Ultimately, the FED wanted to prevent the American economy from falling into a great depression, just like it did in 1929, due to the lack of demand during the pandemic. At this point, Jerome Powell again tried an effective way that worked in the crisis of 2008. In this context, the FED supported aggregate demand by lowering interest rates and increasing the money supply at the same time. In this way, it also followed a policy of supporting employment and production and was partially successful. On the other hand, as every treatment can have side effects, the side effect of “increasing the money supply (printing money) with low interest rates” has emerged as “inflation”.

At this point, when the right time came, the FED managed to reduce the inflation rate below 5 percent as of June 2023 by gradually increasing the interest rates in order to eliminate this side effect without disturbing the economic activity. The FED increased the interest rate to the level of 5-5.25 in May. At this stage, the FED, which left the interest rates fixed in June, is not expected to increase interest rates again in the short term. However, there is also an expectation in the market that the interest rates will be lowered again at the end of 2024 or at the beginning of 2025. In this concept, following the next explanations and statements of the Federal Open Market Committee (FOMC) will be a signal for the future in terms of analysing next steps of Federal Reserve. In this concept FED interest rate cuts issue is important.

SVB Collapse – FED Interest Rate

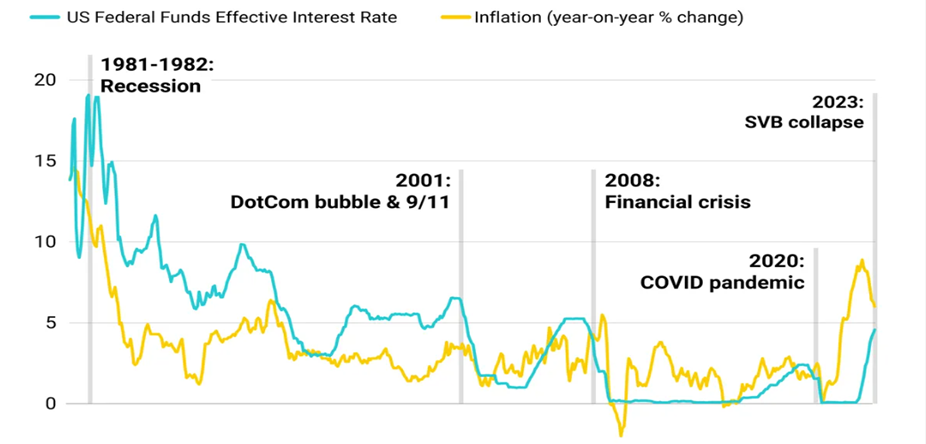

As the My English Articles team, we find it important for personal development and support to follow the current global economic situation and developments. In this context, we think that we should definitely know why the FED increased interest rates in the USA. With this article, we aimed to contribute to your progress in this regard. You can also enrich the subject by adding your comments on the subject below. Finally, we present to you the graph below showing the relationship between interest and inflation in the USA. The blue line shows the interest rate and the orange line shows the inflation rate.

We recommend that you carefully follow the period that started with the technology-based DotCom crisis in 2001, included the 2008 financial crisis, the 2020 Covid-19 pandemic, and finally the 2023 Silicon Valley Bank (SVB) collapse. Do not forget to read our Global Recession 2024 risk post please.

As we are going to the last days of 2024, we should note that the FED plans to make just one interest rate cut this year. In this context, when the FOMC (Federal Open Market Committee) notes are carefully examined, it is seen that if inflation falls as expected, there will be one FED interest rate cuts by the end of 2024 probably November or December.