Contents

We all know that human beings have been in trouble with money and credit interest rate phenomena since the invention of money. Especially after the agricultural and industrial revolutions, money and credit issues have never been off the agenda of humankind. In this context, before modern banks were established, institutional loans were mostly provided by under-the-counter businesses or bankers. In addition, money and credit issues were an integral part of social life in the past, as they are today.

At this point it is known that; the subjects of interest, money and credit interest rate are mentioned in many holy books. If you remember, we previously published our analysis on consumer loans. Today, we will talk about the relationship between interest and inflation on the basis of credit. Again, since we have a detailed article on inflation, we will touch on the relationship between loan interest and inflation without focusing on that issue in too much detail. By the way If you are wondering when loan interest rates will go down, we recommend you read this article as well.

What Are Credit Interest Rates?

In other words, we will be looking for an answer to the question of why loan interest rates are high or what conditions are required for them to decrease which is on the agenda of almost the whole world. Of course, we will try to do this search in a way that the people passing by on the street and those who are not educated in economics can understand. Even more ambitiously, we will portray this relationship through stories.

Otherwise, everyone would make rote statements based on FED by talking about technical information. 🙂 In this context, as we stated in the title of our article, we would like to state at the beginning that we will say it at the end. We wonder if interest rates are really high or if our risk-based problems cause loan interest rates to climb… Since we believe in the power of stories, which have become very popular all over the world recently, we will try to explain even this seemingly difficult subject through storytelling. We hope it will be easy to read for you.

How Are Credit Interest Rates and CDS Connected?

We all remember the classic the very famous children’s story, Hansel and Gretel. In this story, two innocent siblings are left by their stepmother in the forest and they try to find their way home with pieces of bread. The adventure of these two kids who tried to find their way and the truth in uncertainty, touched us all. Just like in this story, “credit rate and interest” are two brothers and their stepmother leaves them in the “inflation” environment, the forest, that is, an uncertain area. So, as you can see, inflation is the forest or uncertainty in this story. 🙂

In connection with this, we need to point out that; Inflation basically means a continuous increase in the general level of prices. Then, in an uncertain environment where inflation is high and prices are constantly increasing, the credit interest rate and interest brothers cannot find their way home, that is, they do not know where to go 🙂 On the other hand, in an environment where the inflation rate is stable and constant, sisters Hansel and Gretel can easily find their way home safely.

It is clear that; in an environment where there are no uncertainties, interest and credit interest rate will remain close to constant. Northern countries or developed countries can be given as examples of this group. An inflation environment of approximately 3 or 4 percent annually and a real interest rate of 1 point above from it, is generally considered appropriate. Generally, in an environment where overall interest rates are appropriate, loan interest rates will also be appropriate and the increase in credit will support economic activity positively (without causing inflation).

Credits, Interest Rates and Realities

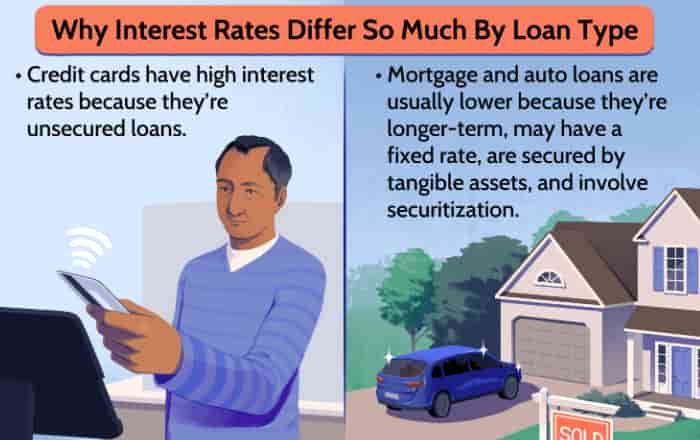

If we separate the subject from stories and adapt it to today, it is clear that; if you want to stimulate the economy by providing loans at affordable interest rates, firstly your inflation should be low. If you want interest rates to be low in today’s world, which is globalizing and information spreads rapidly, your CDS premiums, that is, your country’s risk premium insurance, should be low.

In order to briefly summarize this connection, for interest rates to decrease, your risks must decrease first.

The Role of CDS in Determining Interest Rates!

The word CDS means “Credit Default Swap” in English. To put it very briefly and in a language that everyone can understand, this phenomenon refers to the insurance of the credit debtor’s bankruptcy. So, if we compare a country to a car, just as cars have insurance and insurance premiums, countries also have CDS premiums against the risk of having an accident or going bankrupt.

At this point we could say; if the social, political, military and economic risks in a country are high, naturally the risk of bankruptcy of that country is also high. CDS premiums, that is, automobile insurance premiums, of countries with a high risk of bankruptcy will also be high. Please put yourself in the shoes of an international funding agency that lends money to countries.

Would you rather lend to a country with a high country risk, i.e. CDS premium or a country with a low bankruptcy risk? Of course, everyone wants to lend to the country with the lowest CDS premium. However, if the country with the high CDS premium comes and persistently asks you for a loan, you will say to this country: “Then I will lend you a loan with a higher interest rate.”

Credit interest rate will be high in this situation. If we start from this, as we mentioned before, the decrease in interest rates is directly related to decrease in our risks, our troubles, as well as inflation. Financial institutions today where the world is digitizing rapidly, want to use a risk measurement unit that is valid all the world.

Although rating agencies score countries, credit default swap is a much more reputable unit of measurement. In this respect, CDS is more realistic. Moreover, it is independent of political influences. You can click to see global CDS country list.

Inflation and Credit Interest Rate Relationship

Inflationary environment is a situation we are generally accustomed to in developing countries. However, inflation has also emerged as a serious problem for developed countries, especially after the increase in postponed consumption post the pandemic era and the disruption of global supply chains. In the face of this situation, central banks used interest rates as their most serious tools, and interest rates increased globally. Rising interest rates naturally means rising credit interest rate.

As it is known, after the increase in interest rates, economic activity naturally slowed down and the country’s economies began to face problems such as stagnation and high unemployment, especially the risk of recession.

At this point, if we basically consider the relationship between inflation and loan interest;

- If inflation, that is, the increase in the general level of prices, is high, the producer price index, that is, PPI, will increase again and increase inflation again through the increase in production costs. This also will mean that credit interest rate is high.

- If we go in reverse, from credit interest rate to inflation, in an environment where loan interest rates decrease, consumers will be more inclined to spend and this will trigger demand inflation.

- While credit interest rate is not used as a monetary policy tool in developed countries, recently they have been used as a tool to stimulate the housing market, especially in China, and to achieve economic growth based on consumption in developing countries.

Final Message Deciding Credits

Finally, it should be noted that we have many problems globally and naturally the risk-based inflation rates are also high. We cannot expect credit interest rate to be low in an environment where inflation and risk are high. This means that in order to reduce loan interest rates and inflation, we must first reduce our problems, that is, our risks. At this point, the issue has political, social, legal and many other dimensions. We end the article here by saying that we should all take our share of the message and responsibility from here. 🙂