Contents

Since the birth of the modern economy, all economies in the world have struggled with various crises. In this context, since we have turned from a barter economy to a money-based structure, we have been looking for the most accurate form of financial management. According to some, the Great Depression of 1929, which is believed to have caused a world war in terms of its consequences, and the Global 2008 Financial Crisis, are quite comparable in economic literature. Indeed, the common and different points of these two crises are very important.

It is very obvious that financial crises are now almost a common phenomenon on a global scale. As in the aftermath of the Covid-19 period, international finance institutions such as the IMF, the World Bank and the World Trade Organization come together with countries and states to seek solutions, try to prevent crises from deepening. On the other hand, comparing the causes and consequences of the 1929 and 2008 crises will help us draw lessons for the future.

What Caused the 1929 Great Depression?

The 1929 crisis, just like the global 2008 financial crisis, first started in the US stock market and then spread to the entire world. At the end of 1928, as a type of derivative product, “loans given by banks and other institutions to brokerage houses” began to be used in stock purchases with a certain margin. This transaction can be considered a financial derivative product that is quite superior to the technologies of that period.

At that very moment, the US central bank, the FED, was making serious profits by providing funds at 6% and selling these funds to commercial banks and brokerage houses that purchased stocks at 12%. Brokerage houses were also increasing the funds they provided by using the stocks they purchased as collateral. At that time, a bubble was forming at the end of these transactions, the basis of which was stock prices. However, since everyone was winning, no one wanted to see the elephant in the room.

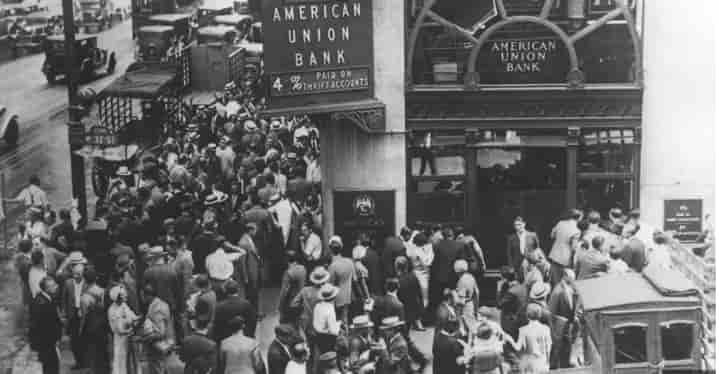

On March 25, 1929, due to increases in margins and commissions, stocks began to fall for the first time in a long period because of sales pressure. On that day, some stocks lost 10-15% of their value. At this point, the interest rates for the funds requested by the brokers from the banks increased from 12% to 14%, and on March 26, approximately 9 million lots of stocks were sold on the stock exchange. This rate represented a very large sale for that period. When stocks lost 20-30% of their value that day, interest rates also increased to 20%. What was even worse was that no one knew what to do.

In this context, it should be noted that the US central bank and government were too late to intervene in this situation.

Overview of the 2008 Financial Crisis

The US economy was dragged into a recession when the bubble known as the dot-com bubble burst in 2001. Developments following the September 11, 2001 attacks led to the deepening of this crisis. The FED Chairman of the time, Alan Greenspan, saw it appropriate to reduce interest rates as the formula for getting the US economy out of recession. In this context, interest rates were reduced 11 times between May 2000 and November 2001.

During this period, interest rates fell from 6.5% to 1.75%. In addition, we should note that as a result of the continuation of the same policy, interest rates fell to the lowest level of the last 45 years, 1%, in June 2003. With the artificial consumption and price increases triggered by this cheap money environment, the US managed to escape the economic recession.

After this period, the easy money period that started with interest rate cuts caused housing loans to increase rapidly. However, as a result of the uncontrolled financial markets, which have been dominant since the 80s, also known as Reaganomics and Thatcherism, derivative products began to expand excessively.

The US financial sector, whose risk appetite was left uncontrolled, made these derivative products even more risky by providing mortgage loans to people with low payment capacity, called sub-threshold. At this point, it should be noted that; the mortgaged home loans used were purchased by bond sales made to the market as collateral, investment banks, hedge funds and various financial institutions, and credit risks spread to almost the entire finance sector.

These developments caused house prices to increase rapidly due to the increase in demand in the housing market. Thus, in 2004, home ownership in America climbed to the highest level in history, 96%. 2008 financial crisis was coming.

How the 2008 Crisis Avoided Becoming a Depression

There is a term in economic literature called cyclical fluctuations. In other words, indicators such as interest, price or exchange rate decrease at certain periods and then increase again. No indicator increases or decreases continuously. Just like this, when the FED increased interest rates again in 2004 as part of the fight against rising inflation, housing loan interests also started to increase since they were mostly “variable interest”. Then, mortgage loans, especially those provided to people with low creditworthiness, began to go unpaid.

When the loans were not paid and the houses used as collateral were put up for sale, house prices suddenly crashed due to excess supply and the prices of the bonds sold using these houses as collateral also fell rapidly.

Since these bonds and derivative products were in the hands of the entire finance sector, everyone started to lose money. In 2007, news of bankruptcy began to come from financial institutions that made investments based on risky housing loans, which worried all markets. During this period, more than 25 institutions providing sub-prime housing loans declared bankruptcy.

Just as the 44% increase in private consumption in the US between 2000-2007 had a positive impact on the world, the sudden cessation of this consumption with the onset of the crisis in 2007 caused the global economy to enter a recession. Here, the reason for the transformation of a crisis that started in the US into the global 2008 financial crisis is that investors all over the world took part in the collateralized debt-securitization market.

Startup Ecosystem and Financial Crisis Relation

If you recall, the collapse of Lehman Brothers, which was said to never go bankrupt at that time, caused a financial crisis that would turn into a debt crisis and spread to the entire globe. It is no coincidence that start-ups became more popular after this period. As a result of the collapse of large companies, investors in particular became interested in investing in new generation smaller-scale enterprises focused on technology rather than traditional companies. It was after this period that start-ups that changed our lives completely began to be established and Silicon Valley became the new focal point in America.

Differences Between 2008 Financial Crisis and 1929 Depression

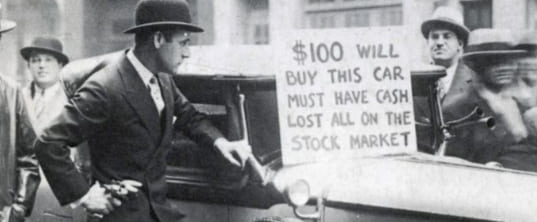

The Great Depression of 1929, which was said to have paved the way for World War II and led to dictators like Hitler coming to power, caused a deep crisis all over the world, especially in America. During that period, people lost their jobs and all their assets. The long duration of the crisis, which temporarily brought an end to classical economics based on the “Let them do it” view, which was based on freedom and liberty, was devastating. That environment was very different from 2008 Financial crisis conditions.

Famous economist Kenneth Galbraight attributes the long duration of the Great Depression of 1929 to the following reasons;

- There was a very bad income distribution in the USA at that time. In other words, about one-third of the total income was in the hands of a segment of 5 percent. The explosion of the crisis caused the income of this segment, which almost made investment expenditures alone, to melt away very quickly and investments to stop. Considering that Keynesian economics had not yet emerged at that time, that is, there were no state investments, total investment completely stopped.

- The corporate structures of that period were very bad due to the weak regulations. Companies with weak financial structures have ceased to be production-oriented due to their interest-based structures and have become incapable of investing.

- Policymakers who expected the economy to come to balance through the “invisible hand” at that time waited for a very long time. The lack of information caused the crisis to deepen due to the weak finance structures of the banks.

- In the 2008 financial crisis, unlike the Great Depression, Keynesian policies were quickly returned to, money supply was increased, and governments took action through public spending. During this period, financial structures were more robust and regulations were more controlling.

New Deal for All Global Economies

With the program implemented by US President Roosevelt under the name of “New Deal” in 1932 and the Keynesian public-state approach,

- Public spending was increased

- Balanced budget was replaced by deficit budget

- Import taxes were reduced

- Money supply was increased

Thanks to these measures, the Great Depression was gradually overcome. On the other hand, with the effects of the long-lasting crisis, chauvinist governments came to power in Europe and around the world, and the road to world war was opened.

Basic Differences Between Today and the Past

The main difference between today and that period is that the world has much more experience and knowledge about economic and financial crises. Moreover, we no longer expect an invisible hand to appear and solve all the problems when we smell a crisis. In this context, the policies and deposit guarantees implemented in the banking system have largely prevented major bank failures and savings meltdowns.

Additionally,, unlike the 1929 period, almost all central banks, especially the FED, are following active monetary policies against crises, injecting trillions of dollars into the markets and preventing crises from deepening. In addition, as in the Covid-19 period, interest rates are also being rapidly reduced and the weapon of expansionary monetary policy is being used to the fullest. (just like 2008 financial crisis)

Unlike that period, governments today do not hesitate to take actions such as tax cuts, incentives and increasing their spending instead of a balanced budget when necessary. However, the issue of liberalizing foreign trade is also very important today. Unlike that period, countries that use foreign trade as a tool have the awareness to act together against the crisis. This prevents the contraction of production and the increase in unemployment. In addition to all these positive differences, the fact that capital density is higher today causes the actions taken by the state to revive the economy in times of contraction to be relatively weak.

As a result, the role and effects of the state in 1929 were much stronger than today. 2008 Financial crisis environment was very different.

In this sense, the fact that markets are becoming more and more global has both positive and negative effects. With the effect of contagion, a crisis that occurs in a large economy today spreads rapidly to every corner of the world through financial systems.